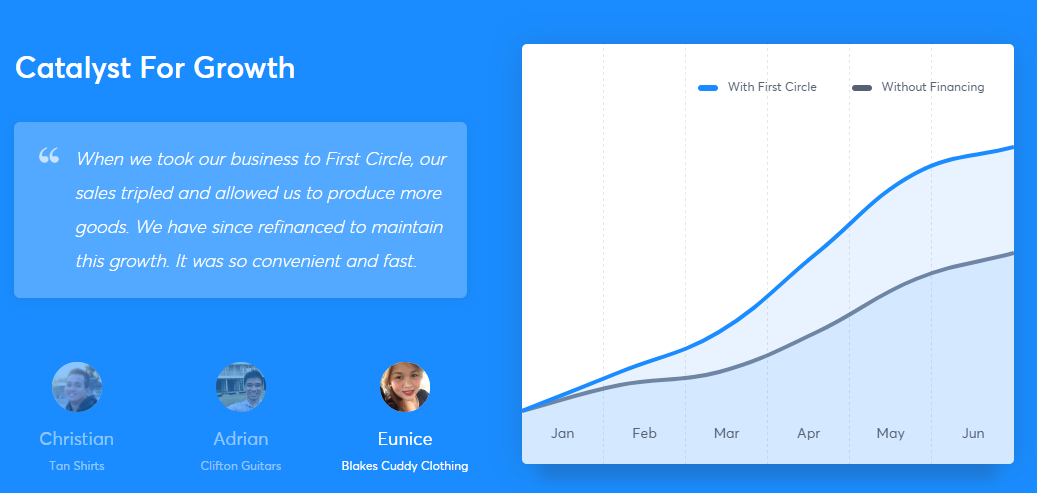

Advances made by Fintech start-ups proves that new business models are possible and required. It’s all about meeting expectations of the consumers and giving them the best solution.

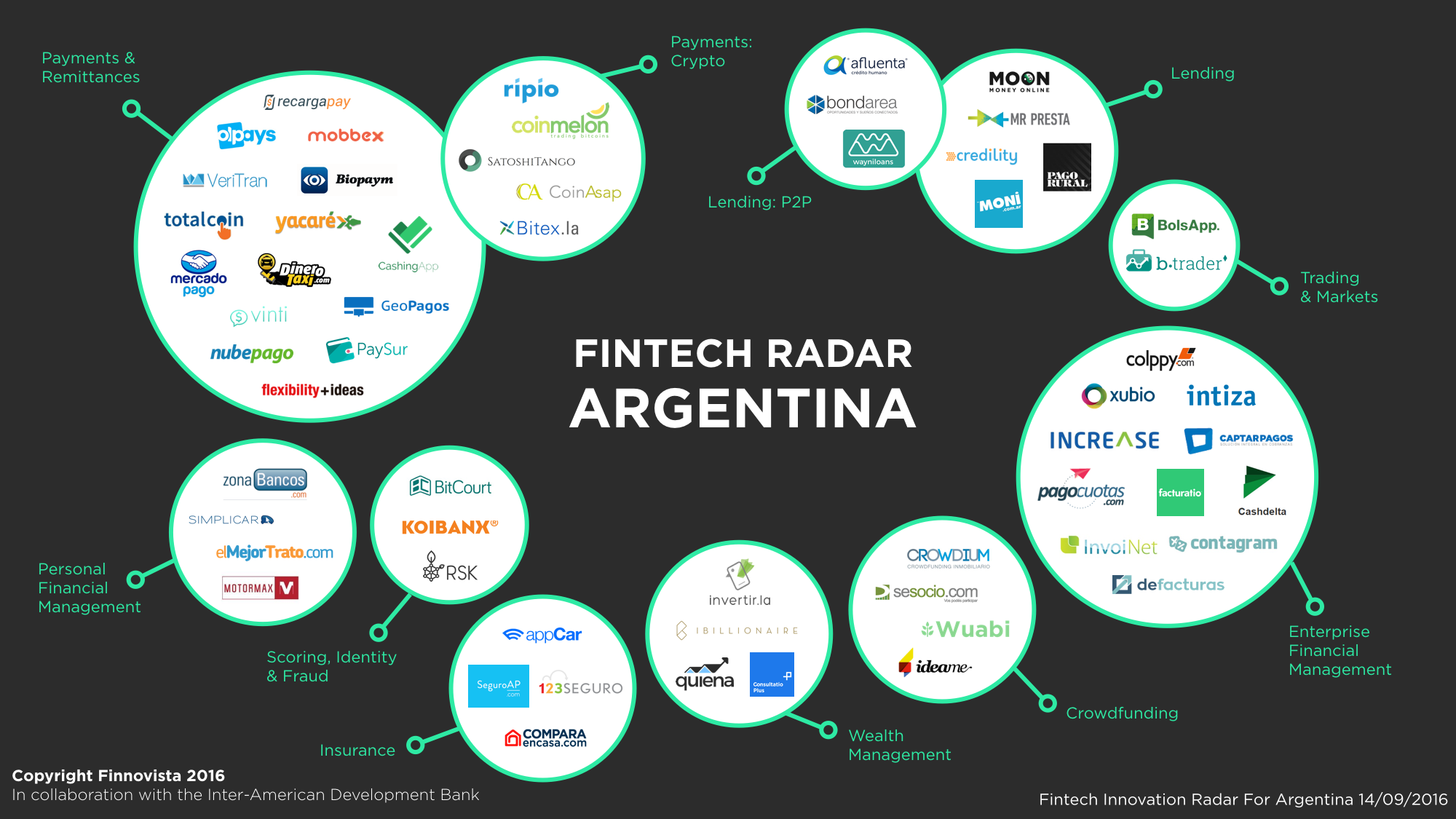

Mercado Libre (NASDAQ: MELI) ignited the alarms of the banks, and consequently, started the discussion together with the Central Bank. After announcing its new service, Mercado Crédito, an online credit platform, several local and international bank groups took on the CBofA stating unfair competition from these new players, the Fintech start-ups.

At the request of Argentine banks to implement new regulations, or even to remove existing regulations, the response from Central Bank’s president Sturzengger-Lucas Llach (the deputy in charge of technological innovation) surprised more than one banker:

“There is no problem in that you create a fintech to go out to lend without this type of regulations”

Meanwhile, some banks started to walk this path of “co-innovation”, partnering with Fintech companies to offer products and services, including credit and international transfers. Few banks are adapting to these changes without waiting the central to implement new rules; and instead want to take a predominant position in this disruption.

There is certainly much more to be done. Blockchain technology is giving its first steps in Argentina with companies like Ripio and the use of algorithms in the granting of credits and handling of the finances still have a long way to explore.

We see possibility of some new regulatory changes to come but those will no stop the threat, banks will have to adapt and spend their money on the use of new technologies that can address clients’ needs.