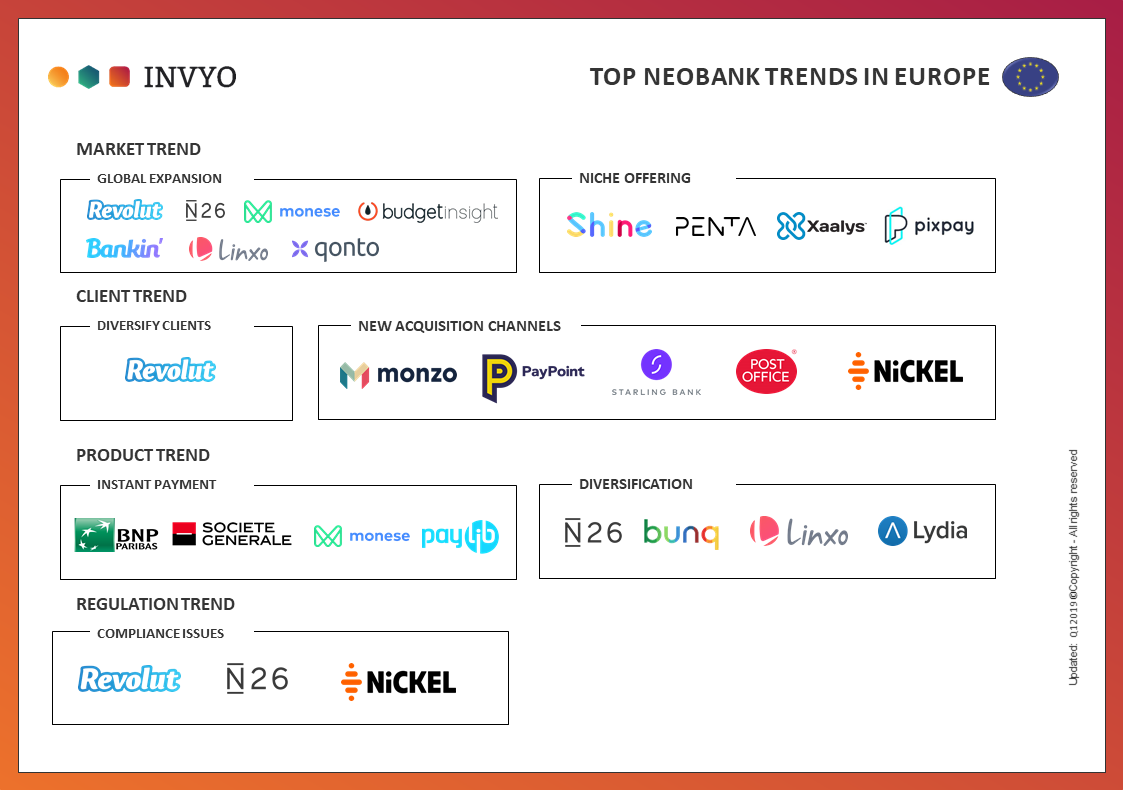

After a thrill of mega deals in 2018H2, the market appetite for European neobank turned lacklustre in 2019H1. Meanwhile, neobanks have pulled themselves back to the ground, eyeing on surviving, growing, and expanding. Going through the value chain, we’ve detected some key trends in the market, client, product and regulation in the sector.

Key takeaways

Trend: Market

- Established neobanks expand across seven seas

- New entrants bet on niche offering

Established neobanks expand across seven seas (1/2)

Bigger, and bluer

Established European neobanks are expanding to the “blue oceans” (ex. Australia, where neobank penetration is low), to neighboring countries (the case of European expansion) or to the bigger markets (ex. USA). Examples:

- British Revolut launched in Austrilia

- German N26 and British Monzo in USA

- British Monese launched in France

- French aggregator Budget Insight launched in Belgium

- French Bankin’ launched in UK, Spain, Germany

- French Linxo launched in Germany

- French Qonto to launch in Germany

New entrants bet on niche offering (2/2)

Competition intensifies, differentiation is the key

New entrants are emerging, with a niche strategy. Examples:

- French startupS neobanks Xaalys and Pixpay target on teenanger banking

- Shine or Penta are offering banking solutions for SMEs and freelancers

Trend: Client

- Established neobanks eye on more diverse user base

- New user acquisition model: online-to-offline (O2O)

Established neobanks eye on more diverse user base (1/2)

Millennials are cool, but we still need Average Joe

Neobanks used to allure mainly tech savvy millennials, (Ex. According to Monzo, About a third of Monzo’s 2million customers live in London and less than 5 per cent are over 60.), which is only a tiny portion of population. To further evangelize the neobanks, a wider and more diverse user base is desired. Two types of new clients are on the front line: the “Average Joe”, and the left-behind.

- The average Joe: Neobanks are targeting more elderly people, living in the countryside, who are less tech-savvy and prefer brick-and-mortal shops and human touch.

- The left-behind: A wave of loss-making retail bank branches (ex. In remote or unpopulated areas) are shutting down to cut costs, leaving concerned clients in a vaccum: physical agencies no longer possible but online service not yet there. Neobanks jump at the opportunity to acquire the left-behind.

Examples :

- Revolut rewrote the client contract, reduced millennial jargons to make it more understandable for “Average Joe”.

New user acquisition model (O2O) (2/2)

When online-only banks are no longer online only

O2O (online-to-offline)

- Neobanks used to be nicknamed as online-only banks. Now wind of change is blowing to adapt to new types of clients: Various neobanks now launched brick-and-mortal distribution channels to facilitate “Average Joes”. The O2O client acquisition strategy is gaining popularity.

- Various neobanks now launched brick-and-mortal distribution channels to establish an O2O type of distribution.

Examples:

- Monzo partners with PayPoint, a payments service offered in about 30,000 shops across the UK.

- Starling collaborates with the Post Office.

- Compte Nickel launched online survey to let users decide where the points of sale should be accessed.

Trend: Product

- Race to Instant Pay

- Diversification of offers

Race to Instant Pay (1/2)

Who is the coolest kid in the town?

In late 2018/ early 2019, instant pay suddenly got big. Both neobanks and incumbent banks are rushing to adopt, and for the first time, incumbents are not losing to neobanks! For example, BNP, Societe Generale proposed Instant Pay back in Nov 2018, months before many neobanks, including Revolut. It may reflects a rising awareness and appetite for innovation amongst incumbents.

2 methods are used:

- Third party solution such as Google Pay/Apple Pay

So far, almost all neobanks have integrated Apple Pay

- In-house solution

Example: Monese has launched Monese-Monese instant pay; 5 French banks co-launched the service with Paylib

Diversification of offers (2/2)

Neobanks used to be pure players promising no-frill service, i.e. only focus on one single financial product, such as debit card, lending, transfer. Now we observe a diversification of offers, in order to better serve and retain clients and earn extra revenue.

Examples:

- The German N26 now proposing credit. saving, investment products.

- The Dutch current account neobank Bunq has new offer in Travel Card.

- The French bank aggregator Linxo is expanding to payment.

- The French payment giant Lydia now have credit offers.

Trend: Regulation

- Regulation risks accumulating

Regulation risks accumulating (1/1)

What’s costing the traditional banks are now costing neobanks

KYC, compliance, cryptomoney subjects, local vs foreign regulation differences… Regulation risks are amounting in the sector.

Examples:

- N26 accused by German regulators of insufficient KYC

- Revolut challenged by by Luxemberg regulators

- Compte Nickel urged by local consumer association to respect reimbursement deadline regulation