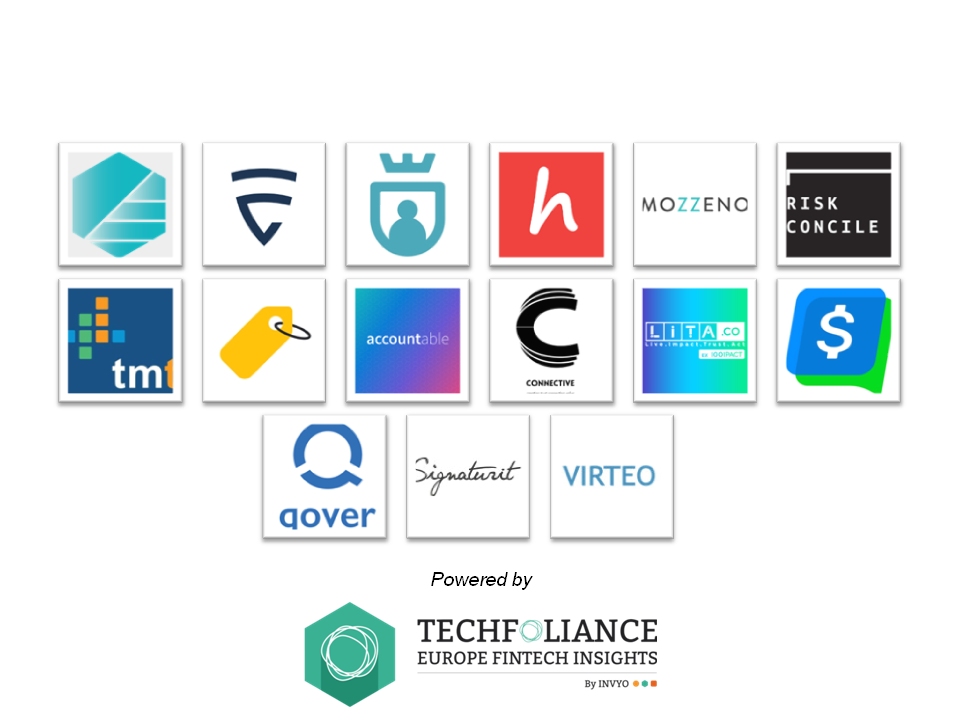

This year, 15 rising FinTech start-ups and scale-ups have been chosen to come and pitch at the Fintech Belgium Summit, the biggest Fintech event in Belgium.

For this year’s edition, you will learn all about the latest trends in FinTech, ranging from PSD2 directives to Blockchain technology over to CyberSecurity, AML, automation, AI, ICOs, new investment solutions and change management.

[divider]FINTECH START-UPS[/divider]

Digiteal

Digiteal is a Belgium-based Fintech that has developed a free personal assistant that optimizes the management and the payment of invoices in one single place. Digiteal is an innovative channel to present customers’ outgoing invoices electronically to their customers, in a more effective way than sending by email.

Discover here: https://www.digiteal.eu/

Elimity

Elimity is a Belgium-based Fintech that is a spin-off of the University of Leuven that provides a software product to improve the internal security of large-scale financial institutions such as banks. Its access management platform ensures that highly-regulated companies remain compliant throughout the coming years.

Discover here: https://elimity.com/

Juru

Juru is a Belgium-based Fintech that has developed a GDPR compliant platform to provide a secure way to store customers’ files and respects their privacy even when sharing. The data is stored in a private permissioned blockchain.

Discover here: https://juru.io/

Hublio

Hublio is a Belgium-based Insurtech that has developed a digital insurance and finance assistant. The start-up stores customers’ policies, financial information & subscriptions on one intelligently automated platform and let people know if they are overinsured, have duplicate or missing cover, and if they can get products they need better elsewhere.

Discover here: https://hublio.com/

Mozzeno

Mozzeno is a Belgium-based Fintech that has launched the first Belgian platform allowing investors to indirectly invest in the funding of consumer loans. Individual borrowers can be granted a loan from mozzeno, authorized lender. On the other hand, to invest in the funding of these loans, investors subscribe to financial instruments issued by mozzeno.

Discover here: https://www.mozzeno.com/

RiskConcile

RiskConcile is a Belgium-based Fintech that has developed a cloud-based solution to inform managers of the fund on a daily basis on different risk measures: market risk, liquidity risk, counterparty risk and leverage risk.

Discover here: https://www.riskconcile.com/

TheMarketTrust

TheMarketTrust is a Luxembourg-based Fintech specialised in high-tech and sophisticated solutions in risk-analysis, big data and behavioral finance. Its solutions are based on custom software and on an open-source license.

Discover here: http://themarketstrust.com/

ZappTax

ZappTax is a Belgium-based Fintech that has developed a solution to help international travelers to more easily obtain refunds of the value added tax (VAT) they pay on goods they purchase while traveling abroad.

Discover here: https://zapptax.com/

Accountable

Accountable is a Belgium-based Fintech that has developed a financial assistant for the self-employed worker. By tapping into bank transactions, the start-up provides real-time tax optimisation recommendations for its users. With its app, it aims to redefine the banking, accounting & tax advisory experience for freelancers, consultants, architects, M.D and the like.

Discover here: https://www.accountable.eu/

[divider]FINTECH SCALE-UPS[/divider]

Connective

Connective is a Belgium-based fintech that is delivering European Identity services & digital signature solutions. With its Digital Transaction Management software, the start-up enables businesses and other institutions to transform any paper-based customer journey (e.g. digital onboarding, KYC and contract management) into an unparalleled digital user experience.

Discover here: http://www.connective.eu/

Lita.co

Lita.co is a Paris-based Fintech that has developed an equity crowdfunding platform to connect private investors with companies that have a high social impact.

Discover here: https://fr.lita.co/en

PayKey

PayKey is an Tel-Aviv-based Fintech that has developed a social banking and mobile P2P payment solution. The scale-up has launched a patent-pending mobile payment keyboard that seamlessly integrates with banking application and let users complete a transaction without leaving their social application.

Discover here: http://www.paykey.com/

Qover

Qoover is a Belgium-based Insurtech that provides “Insurance As A Service” allowing any business to integrate proprietary insurance products from their library via open API’s.

Discover here: https://www.qover.com/

Signaturit

Signaturit is a Spain-based Insurtech that provides an electronic signature and document management software platform to send and sign legally binding documents online. The platform allows users to send and sign PDF documents directly from the e-mail server or can be integrated directly onto the companies’ workflows through it’s API.

Discover here: https://www.signaturit.com/

Virteo

Virteo is a Belgium-based Fintech that provides public and private corporations with efficient and transparent solutions that will ensure data privacy compliancy, allow SLA monitoring and benchmarking.

Discover here: https://virteo.com/