Techfoliance is super excited to launch its new serie [Fintech Brazil] with inside success stories and analysis shared by top local experts and entrepreneurs.

Brazil has been lately on top of international headlines. Political instability, corruption scandals and economic recession have been increasing the perception of risk associated to the country and shadowed (to a certain extent) positive developments that deserves to be highlighted.

Brazil has a vibrant start-up community tackling the various issues the Latin American giant faces by bringing successful business models from abroad and increasing the list of innovations “made in Brazil”.

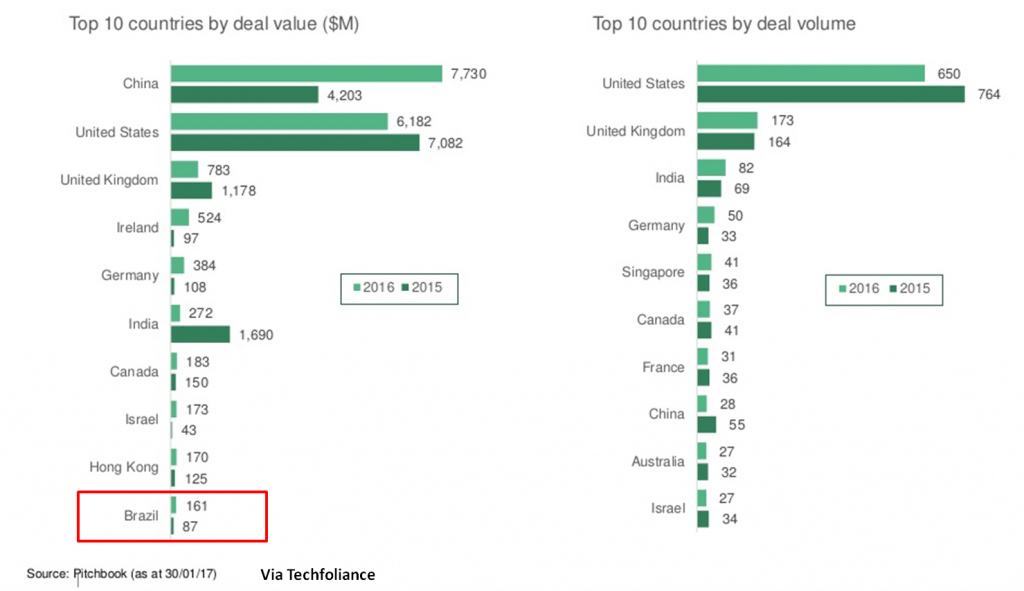

Investments in Brazilian Fintechs amounted to USD161m in 2016, a staggering 85% growth when compared to 2015, placing Brazil among the top 10 countries worldwide by deal value.

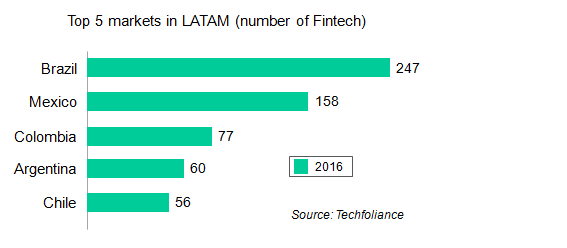

Additionally, Brazil is the leading Fintech hub in Latin America, with over 244 Fintechs.

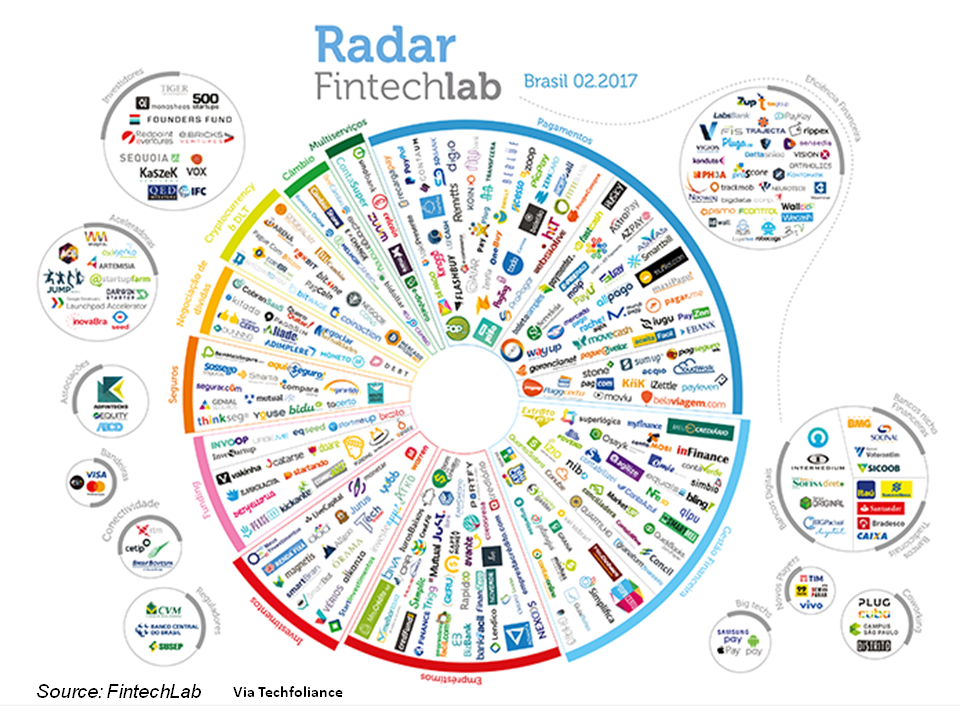

Leading sectors

32% of the Fintechs operate in payments, the leading sector in the ecosystem. Success cases include MercadoPago, Pagar.me and Nubank, which attracted almost USD180m in investments from Goldman Sachs and well-known international venture funds, including Peter Thiel’s Founders Fund, Sequoia Capital and Tiger Global Management. Finance management and alternative lending come second and third, with 18% and 13% of the Fintech start-ups.

Alternative lending platforms deserve special attention due to its growth and recent capacity to attract investments (e.g. Creditas (previously BankFacil) raised BRL 60m in February 2017 from the IFC, Naspers, Redpoint e.ventures and other leading VC investors, on top of BRL 25m raised previously in June 2016).

Many platforms rely on partnerships with small- to mid-sized banks that lend their balance sheet and license to ensure regulatory compliance, using the partnerships as a leverage to increase scale.

Despite the recent growth and undeniable potential, alternative lending in Brazil faces fundamental issues linked to the country’s underlying economic conditions: high interest rates (12.25% as of March 2017, down from 13% in the beginning of the year) and the availability of several high yield market instruments make it harder to develop compelling securitization mechanisms to resell loan books. Pushing higher interest rates to customers is a possible solution but decreases overall value proposition. Significantly increasing customer base and book size to capture economies of scale, increase cost effectiveness and be able to increase the reward for external investors for taking the risks seems a more viable solution, but such a large player is yet to be emerge in the market.

Fintech has a significant potential to transform the financial sector in Brazil – and Techfoliance will keep you posted about its ecosystem, entrepreneurs and innovators in the next few months.

I would like to thank Fintech ecosystem experts Denisse Cuellar and Bruno Diniz for contributing to this article.

Bruno Diniz is a partner at Innercore Solutions. Based in the main financial hub in Latin America, São Paulo, Brazil, Innercore Solutions Ltd provides Matchmaking, Consultancy and Advisory services on innovation for the Financial Services industry. Innercore Solutions Ltd also makes Events, promote Fairs, Workshops, Hackathons, onsite Trainings and Lectures about Fintech, Innovation and Digital Transformation.

Denisse is a Fintech and entrepreneurship enthusiast. She currently works at BCP Bank of Peru building relationships with Fintech and startup ecosystems in Latin America. Graduated from NEOMA Business School and MBA from University of Chicago, she used to be a consultant and strategist in the Financial Services industry and the Fintech sector. She is a blogger and writes for some publications about the Fintech market in Latin America.