Juin 2007 : Apple lance son premier iPhone, qui ouvre l’ère des smartphones.

Près de 15 ans après, difficile d’imaginer la vie quotidienne sans ces petits appareils.

En parallèle, les ordinateurs personnels et l’accès à Internet se sont démocratisés.

Dans ce monde hyper connecté, le nombre de data échangées, créées par chacun d’entre nous, explose.

C’est une bonne nouvelle pour les entreprises : en s’appuyant dessus, elles peuvent réaliser leur veille de marché et détecter des opportunités pour leur activité.

Pas simple cependant de s’y retrouver dans la multitude de data et de les exploiter efficacement.

Comment procéder pour réaliser une veille de marché efficace en 2021, grâce à la data ?

C’est tout le sujet de notre article, bonne lecture !

Prendre des décisions stratégiques grâce à la data

Vous n’avez pas pu y échapper : le développement des nouvelles technologies a apporté des changements profonds dans tous les secteurs d’activité. Les entreprises ont dû s’adapter à l’accélération de l’innovation. Celle-ci a notamment provoqué de nouvelles attentes de la part des consommateurs : plus de personnalisation, plus d’immédiateté, plus de simplicité, etc.

Votre entreprise, et vous, en tant que dirigeant, doit s’adapter à ce nouveau rythme – et même l’anticiper – pour que vos produits et services restent actuels, différenciants et pertinents pour vos prospects. Comment ? En recueillant des data. Celles-ci permettent de comprendre les évolutions en cours et de prendre des décisions stratégiques éclairées. Le tout est d’identifier les data pertinentes et de savoir les exploiter.

Veille de marché et infobésité

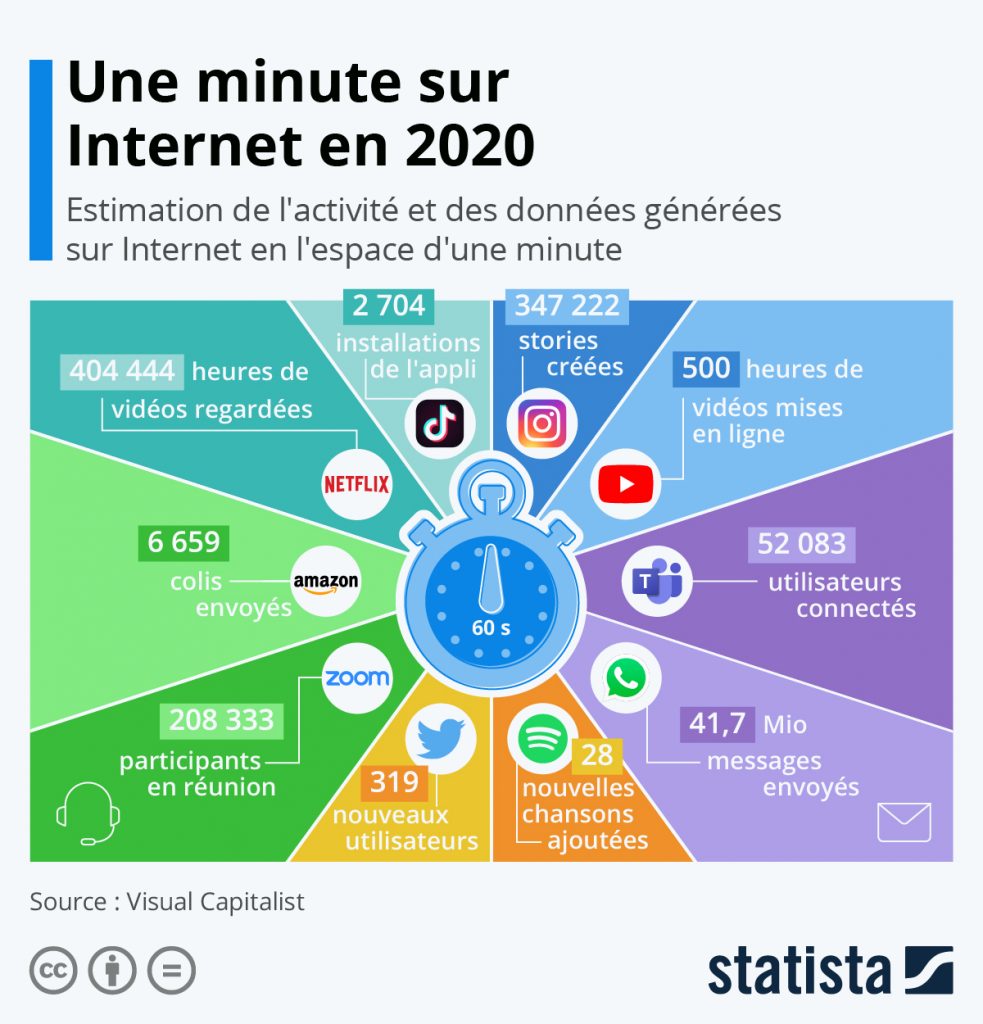

Quelles sont ces fameuses data à recueillir et étudier ? Le terme peut sembler nébuleux, très lié à l’informatique. En fait, ces data sont partout. Pour que vous en ayez une idée plus précise, voici une illustration de ce qu’il se passe en 1 minute sur internet en 2020.

Ce schéma que l’on pourrait nommer “La data ne dort jamais”, à juste titre. Les réseaux sociaux et autres plateformes sont des sources inépuisables, ou presque. En 2010, Eric Shmidt – alors PDG de Google – déclarait :

“Nous créons autant de data tous les deux jours que toutes celles créées depuis le début de l’humanité jusqu’en 2003.”

Si la citation vous interroge, elle a été confirmée par plusieurs études. Et nous avons d’ailleurs dépassé largement ces seuils depuis 10 ans : en 1999, 1,5 hexaoctets d’information avait été produit par l’humanité, soit 1 610 612 736 gigaoctets. En 2020, il s’agissait de près de 50 zettaoctets. Sachant qu’un zettaoctet est égal à mille milliards de gigaoctets, nous vous laissons imaginer les data que cela représente !

Un autre élément à prendre en compte, non négligeable : les data sont également privées pour partie. Expliquons-nous : elles appartiennent aux entreprises, particulièrement les grands groupes. C’est ce qu’évoquait Virginia Rometty, alors PDG d’IBM en 2017 :

“Twenty percent of the world’s data is searchable. Anybody can get to that 20. But 80 percent of the world’s data, which is where I think the real gold is, whether it’s decades of underwriting, pricing, customer experience, risk in loans – that is all with our clients.”

Encore faut-il savoir exploiter ces data, qui dorment souvent sur des serveurs, faute d’outils et de compétences pour en faire sens.

C’est le paradoxe que nous vivons aujourd’hui : la data est présente partout, facilement accessible. C’est une excellente nouvelle pour les entreprises : vous pouvez l’utiliser pour prendre vos décisions stratégiques. En revanche, il n’a jamais été aussi compliqué de l’exploiter efficacement : vous en faites sans doute l’expérience, vos équipes sont probablement noyées sous des masses d’informations. Il est difficile d’identifier les points pertinents, sans se laisser submerger par ceux qui ne vous concernent pas.

Cela se traduit par des temps de recherche longs, avec des processus peu précis. Les signaux faibles sont difficiles à détecter. Même si vos équipes réussissent à extraire les informations pertinentes, il est souvent difficile de faire parler la data et de l’exploiter pour orienter vos décisions.

S’appuyer sur la technologie pour optimiser sa veille de marché

Heureusement, la technologie vient à votre secours : des outils proposent des solutions pour recueillir la data facilement. Chez INVYO, nous allons plus loin : nous nous connectons à d’autres solutions pour recueillir les data, qu’elles soient internes ou externes à votre entreprise, et nous les traduisons pour que vous puissiez réellement prendre des décisions en vous appuyant dessus.

Prenons le cas d’usage de l’un de nos clients, Exton Consulting. Ce cabinet de conseil en stratégie et management, spécialisé dans les services financiers, réalise de nombreuses études pour le compte de ses clients. Leur but est simple : monitorer un marché pour en expliquer les problématiques aux décideurs de la banque et de l’assurance.

Pour faciliter leurs recherches, ils utilisent la solution Market Data Discovery d’INVYO. Pourquoi ?

“Il est difficile de s’y retrouver dans les data, nos analystes peuvent facilement se noyer dans la myriade d’informations disponibles. Grâce aux algorithmes data d’Invyo, nous avons automatisé notre veille de marché. La technologie vient en soutien à notre expertise : nous nous appuyons sur les data récoltées pour faire des recommandations à nos clients”.

– Jean-Louis Delpérié, associé, Exton Consulting

Les équipes d’Exton Consulting peuvent facilement cibler des phénomènes pour les expliquer grâce aux solutions d’INVYO. Si, vous aussi, vous cherchez à faire parler la data, vous pouvez suivre notre blog pour commencer … et nous contacter si vous êtes prêt à passer à l’action !