Fintech is often talked about as a revolution – but in Egypt it is more of a democratization. By making financial services more widely available and lowering costs and barriers to access finance, financial technology (fintech) can democratize financial services to the masses – starting with the 23.2 million Egyptian women who remain excluded from the formal financial system.

In a bid to accelerate women’s financial inclusion in MENA, the region with the lowest female economic participation in the world, the DFID-funded Arab Women’s Enterprise Fund (AWEF) led a study to understand the scope for Digital Financial Services (DFS) in Egypt, map key constraints to women’s financial inclusion and identify opportunities to transform the livelihoods of low-income Egyptian women through improved access to finance.

This blog highlights the main findings of this study, by 1) setting the scene on the gender finance landscape in Egypt; 2) mapping key stakeholders in the women’s financial inclusion ecosystem; 3) identifying main constraints to female access to, and control over, financial resources and, last but not least; 4) presenting AWEF’s strategy to democratize financial services for poor women in Egypt.

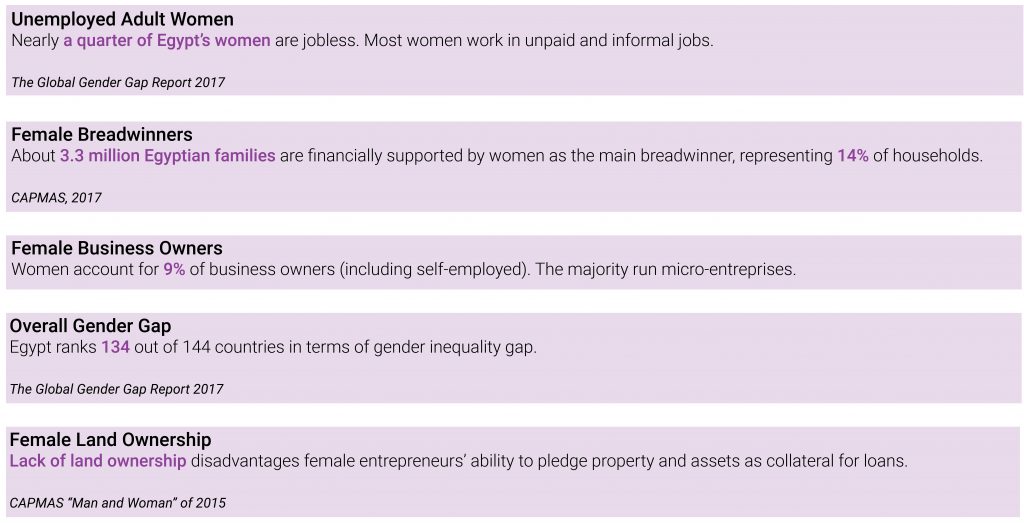

Setting the Scene: Women’s Financial and Economic Exclusion in Egypt

Access to financial resources is widely acknowledged as a key condition to women’s economic empowerment.

In Egypt, women’s economic and financial empowerment is a governmental priority and even though female financial inclusion is on the rise, women remain disproportionately excluded from the formal financial system. Only 27% of adult women have a financial account (versus 39% for men) – a gender gap of 12 percentage points that has not only increased over the last three years but also remains considerably above the global average for developing markets.

Putting this into perspective: Egypt now has about 23.2 million unbanked or underbanked adult women.