This is our 3rd stop in our Fintech Road Trip. To celebrate, our team met Lucien, the founder of OhMyGeorge!, a Bangkok-based Fintech that makes trading accessible to everyone :

[one_half][divider] The company [/divider]

OhMyGeorge is a financial trading game simulation featuring a level-up system that aims at making investing accessible, unintimidating and fun. The app lets you assess your risk appetite, analyse your investment behaviour and improve your emotion management skills. The team is taking its inspiration from Candy Crush and Zelda. Founded in 2015, the start-up is based in Bangkok.

[/one_half]

[one_half_last][divider] The entrepreneur [/divider]

Lucien Tavano is the founder of OhMyGeorge. Lucien graduated from ESSEC Business School and then worked during two years and a half as a corporate sales executive at Stelia Aerospace in Bangkok. He is interested in bringing to life innovative, fun and/or crazy ideas while building millennial-friendly company cultures.

Lucien Tavano is the founder of OhMyGeorge. Lucien graduated from ESSEC Business School and then worked during two years and a half as a corporate sales executive at Stelia Aerospace in Bangkok. He is interested in bringing to life innovative, fun and/or crazy ideas while building millennial-friendly company cultures.

[/one_half_last]

We headed to Bangkok to meet the team behind OhMyGeorge, a Fintech mobile-app still in beta testing with full of potential.

We are in a café, it is Tuesday the 22nd of March – 17:00 local Time

[divider] The Interview [/divider]

TECHFOLIANCE

Hi Lucien, we are very glad to meet OhMyGeorge today !

LUCIEN

Hi Techfoliance, that’s pretty cool that you stopped to Bangkok (laugh) to meet us.

[tabs tab1=”Story” tab2=”Target” tab3=”Approach” tab4=”Goal” tab5=”Revolution” tab6=”Anecdote”]

[tab]

TECHFOLIANCE

We met you in Paris during a pitch session and we have to admit that you were the one that caught our attention. You’ve already created such a strong company culture…. Can you tell us a bit more about the story of OhMyGeorge ?

LUCIEN

Thanks for your kind words. Well, I decided to create OhMyGeorge after I got fed up of not being able to find a sustainable trading strategy despite my repetitive attempts. The interface of the trading platforms were sort of responsible for it. At the same time I was amazed by the level of emotions trading could provide, and being a gamer at heart, I saw the potential for the gamification of that environment. And that’s the DNA of the brand, “Oh My George!” translates the emotion you have when you “play” with your money, even if it’s just $1 (Ed. the face that appears on the 1-dollar note is George Washington’s).

[/tab]

[tab]

TECHFOLIANCE

So your strategy compared to most actors on the market (such as Robinhood) is to approach trading as a game, right ? We love that ! But you agree that your early-stage adopters won’t be Mr. ‘Tout le monde’ : What target do you want to reach with OMG ?

LUCIEN

We are building OhMyGeorge for the mobile-first generation, who prefers to go to its dentist than listen to its bank (71% of US millennials). With our little casual game, we want to bring that generation to the financial markets and take it from day trading (the most appealing way to be involved in the market for a beginner) to investing (yes, it’s a long way) and even planning for their retirement. Ultimately, we want to create a mass market household brand in the financial services sector that people actually trust and love, and we think a gaming brand is the right angle to achieve that.

[/tab]

[tab]

TECHFOLIANCE

Your team is a fantastic example of the new generation of startupers : you have ‘no home’ because you want to work from everywhere (sometimes in Bangkok, sometimes in Singapore or in Paris) and your team comes from everywhere because you know that in 2016 you can work with talented people from around the world. However, you started launching your business in Asia instead of US or Europe : What are the main advantages you have to create a Fintech in Asia ?

LUCIEN

Most of the time, availability of capital is key to launch your start-up. Asia is currently seeing a massive availability of early stage venture capital. I remember a Singaporean VC explaining that they have so much money they can’t find enough good startups to invest in. Interestingly, it doesn’t matter much if you are based in Tokyo, Beijing, Taipei, Bangkok, Singapore, or Jakarta. In Asia, VCs are regularly touring the region, so you can catch them anywhere. At the same time, the lower cost of living, especially in Thailand, enables founders to bootstrap significantly longer than if they were building their company in the US or Europe. So we are really winning on both aspects.

OhMyGeorge being at the crossroad of FinTech and Mobile Gaming, we also chose Asia as a base and “domestic” market because mobile gaming is strong in that region: there are about 750 million mobile gamers in APAC, who spend almost as much money on mobile games (more than $4 per month per paying user) as Europeans do, despite a lower purchasing power.

[/tab]

[tab]

TECHFOLIANCE

You said you wanna create a strong enough corporate culture to make people feel confortable with finance : How do you think you will change people’s lives with OMG ?

LUCIEN

Our goal is to bring to the financial markets the Y generation, a generation that grew up during the 2008 crisis, and which as a result both distrusts these markets and lacks financial knowledge. Investing on the financial markets is the most liquid investment solution available, well-suited to rapidly-changing life conditions, millennials love that, since they hate to commit or to plan. With gaming, we will be perfectly positioned to attract, educate and orientate the general public to the right products or service providers.

[/tab]

[tab]

TECHFOLIANCE

Studies show that most people don’t know that new financial solutions are designed to fit their needs and expectations : According to you, what is the best way to make people better understand the sector of Fintechs ?

LUCIEN

Gamification? Ahah, no but seriously, we need to talk in familiar terms and by similarities. Let’s face it, FinTech is at the end of the day just a fancy word, because almost all companies in that sector are tech by nature, some are just more modern than others as they enjoy the privilege of not having a technological debt.

Ultimately, FinTechs are financial companies for the modern life. I am currently trying to have some money wired from my French bank account to a Hong Kong-based service provider I contracted (note: Hong Kong is not an IBAN country…). It’s been 10 days, and after 2 emails, a visit to the closest agency of my bank, and 2 phone calls I still have no idea when my transfer will be executed or how much it will cost me (!!!). I wish we were already 5 years in the future and my contractor could accept TransferWise.

[/tab]

[tab]

TECHFOLIANCE

We are used to asking each start-up if they have an anecdote to deliver about their company : something funny, difficulties you have faced, the team, etc.

LUCIEN

I can’t be too specific on that one, but I can say we got in bed too quickly with the wrong partner for our startup at a very early stage of our formation, and until we ended that relationship it literally drained our energy and focus. But at the same time, it really helped forged a strong, cohesive team.

Fun fact : we actually have “hidden co-founders” (a.k.a. our girlfriends) who support our mood swings and are our beloved beta testers (read “guinea pigs”). The truth is, the stats have spoken, they are actually better than us at OhMyGeorge !

[/tab]

[/tabs]

OPPORTUNITIES

Wanna go to Bangkok to work with a talented and dynamic team ? You don’t believe us that you could work in better condition in a startup ? Checkout the pic’ below :

Ouch, we agree with you, it hearts to feel that some people are trying to change the world in that kind of condition 😉

WHAT’S NEXT ?

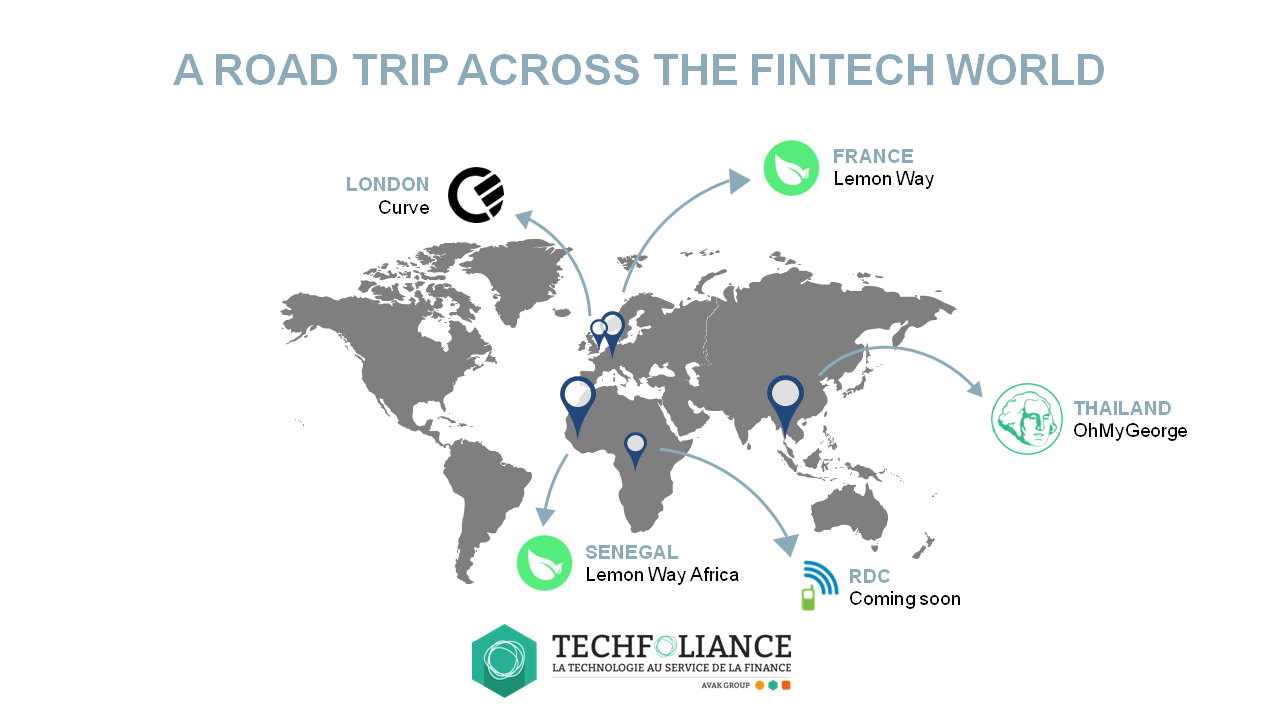

We conclude our interview here. We hope you enjoyed discovering this amazing start-up ! Follow us on our quest accross the world of Fintech and see on the map what will be our next stop :

Stop 1 : France – Lemon Way – Payment Service Provider for Marketplaces

Stop 2 : London – Curve – All your cards in one

Stop 3 : Sénégal – Lemon Way Africa – Mobile digital wallet