Wealthfront is a market leader among automated investment advisors, also known as “robo-advisors”, which are a disruptive force in the wealth management and financial advisory industry.

The company’s mission statement, “Everyone deserves sophisticated financial advice”, sums up the essence of their value proposition, which is to make financial advisory services accessible to everyone. Historically, these services were restricted to wealthy individuals because of the associated costs.

Wealthfront addresses this problem on all three levels of Doblin’s framework of innovation.

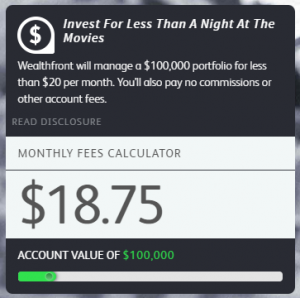

On the configuration and offering level, Wealthfront has managed to break the cost structure of the industry by streamlining and widely automating processes. Using an investment strategy that is based on algorithms and cost effective ETF products, Wealthfront is able to be cheaper than its traditional competitors while still offering their clients portfolios that are tailored to individual risk/return profiles.

At the same time, on the experience side, Wealthfront has created an extremely appealing interface and combined it with a high level of service.

Their innovative customer experience includes a very user-friendly on-boarding process (ex: 5-minute setup; no minimum withdrawals/deposits; automatic deposits) and also offers product related services like automated portfolio rebalancing or tax-loss harvesting.

The client segment that Wealthfront aims to address is rather large at first sight. In general, it encompasses all investors that do not own enough assets to be on the radar of traditional wealth managers or investors that are too cost sensitive to use their services.

However, despite this very general appeal of the idea behind the product, there is a more nuanced approach to understand which clients Wealthfront is targeting.

The company segments their market into two main categories.

On one hand “reluctant DIY’ers”, individuals who have a preference for some aspect of a human financial advisor but do not have the necessary assets for such a service.

On the other hand “delegators”, individuals willing to save and invest money, but nevertheless comfortable with delegating this activity to an automated service.

Launched in the Silicon Valley, an environment that is inherently tech savvy and open to innovation, it is understandable that Wealthfront’s primary targets are the “delegators”.

Initially, Wealthfront had focused on Millennials, a demographic that reflects the criteria of “delegators” particularly well for various reasons ranging from lack of interest or knowledge regarding financial matters, to distrust in the traditional financial institutions, all the way to their preference for products that cater to their desire of being empowered.

This approach to client segmentation is also a good starting point in order to understand why Wealthfront is particularly well suited to the address the initial problem.

Millennials represent a market with increasing importance but also a target that traditional players struggle to connect to. In addition, many in the wider population have lost their trust in traditional financial institutions after the financial crisis of 2008.

Focus on a fully automated investment service

Wealthfront was among the first companies to address this growing market by offering a cheaper, innovative product with superior service and high user-friendliness. In the eyes of the customer, their focus on a fully automated investment service clearly differentiates them from the traditional competition.

By combining both financial experts and Silicon Valley’s best technology talent they position themselves as an innovative company representing the future of financial services. In combination with their superior service this creates a brand that people are confident to trust in.

The trust of the clients manifests in the strong growth of Wealthfront’s assets under management over the last couple years. At the end of 2015 the company was managing about $3 billions of investments with a monthly growth rate of 5%.

In order to generate revenue, Wealthfront relies on a rather traditional model, earning 0.25% on all assets managed and interest on deposits.

According to estimations, the company’s annual revenues total $7 million while costs are between $40-50 millions.

While this situation can be attributed to the initial losses required to support growth (j-curve), Wealthfront will have to tap into additional customer segments and create new revenue streams in order to continue their growth.

In this regard, in addition to continuous improvements to their infrastructure, further innovations on the front-end seem to be of particular interest as Wealthfront has started integrating payment applications like Venmo.

Finally, in the increasingly competitive market of robo-advisors, innovations at the intersection of the different fields of the fintech ecosystem, like the use of social physics during the creation of investor profiles, could be a way to further strengthen Wealthfront’s future value proposition.