Techfoliance wants to highlight key data and information from the most interesting Fintech reports and researches so that you can go straight to the point.

Devie Mohan, a fintech advisor, writer and researcher, in partnership with the Berlin-based Finleap recently published their first Fintech report: The Challenger Banking Industry and Trends.

Key FIGURES on Challenger Banks

The UK itself has witnessed over 30 challengers applying for a banking licence in the past four years, but just 8 banking licences were granted by regulators between 2010 and 2015.

Customer confidence in banking: UK – 33%, France – 33%, Germany – 40%, Italy – 24%, USA – 37%, Thailand – 89%, Malaysia – 86%, Philippines – 77%, China – 72%, India – 70%.

Smartphone penetration: Singapore – 92%, South Korea – 82%, UK – 75%, USA – 70%, Germany – 65%, Hong Kong – 63%, China- 58%, Israel – 57%.

Market acceptance; 57% of consumers in the UK have been with their account provider for more than 10 years and 37% for more than 20 years. Less than 3% switched their personal current account in 2015.

By 2020 student debt is expected to grow to a staggering $3 trillion.

Adoption propensity: Hong Kong (29%), US (17%) and the UK (14%).

SME Lending: On average, credit bureaus in the EU only have credit information on 67% of SMEs, reducing SME loans.

UK regulation: The FCA regulates ~56,000 firms providing financial products and services to both UK and international customers.

Key FACTS on Challenger Banks

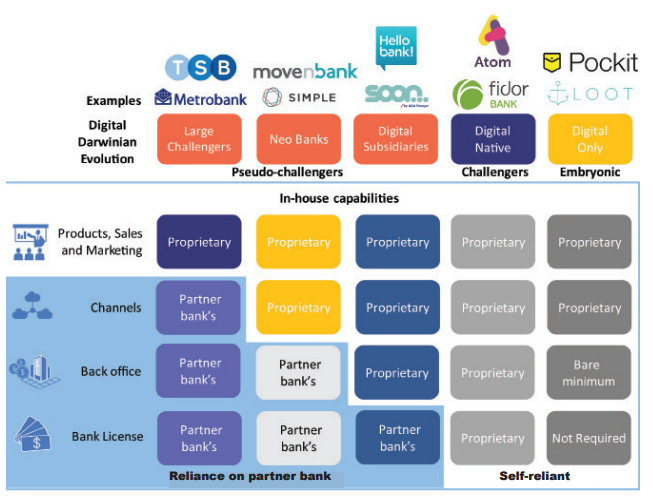

3 types of ‘Challenger Banks’: embryonic, real and pseudo challengers

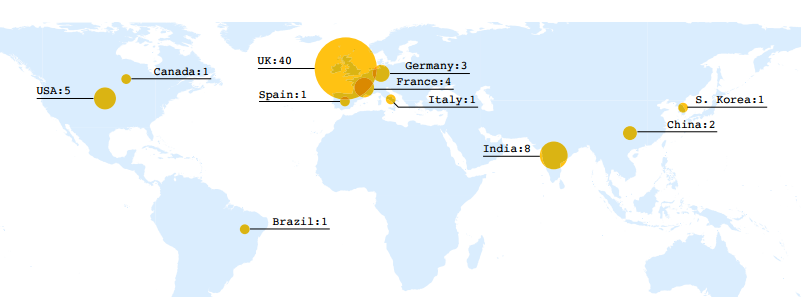

The location of Challenger Banks:

Regulation: Newer banks are required to hold more capital (8 -10 times higher than big banks) because they have fewer years of data on the robustness of their lending.

Too see the full report, please follow this link

[…] Customer confidence in banking: UK – 33%, France – 33%, Germany – 40%, Italy – 24%, USA – 37%, Thailand – 89%, Malaysia – 86%, Philippines – 77%, China – 72%, India – 70%. […]

[…] FCA regulates ~56,000 firms providing financial products and services to both UK and international […]