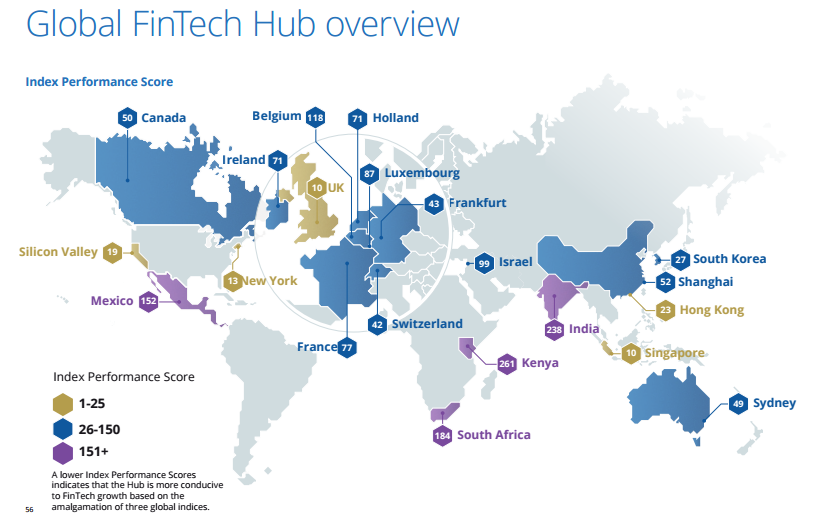

Deloitte recently published a report on the state of the 21 emerging and established FinTech Hubs from around the world.

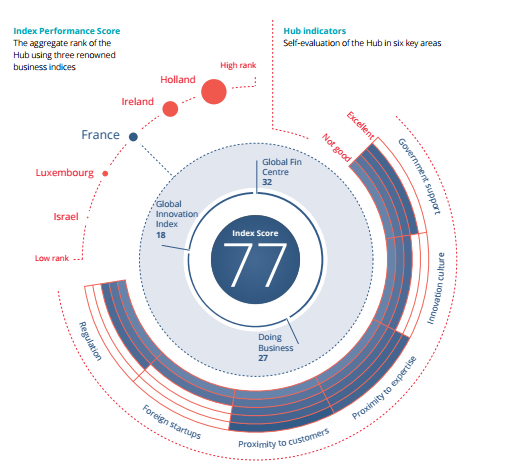

The report established an index performance score that is based on 6 key factors: the government support, the innovation culture, the proximity to expertise, the proximity the customers, the regulation and the foreign startups part of the program.

Unsurprisingly you can see that the 5 countries (UK, Singapore, New York, Silicon Valley and Hong Kong) with a gold color are leading the global FinTech landscape. More interestingly, you can notice that key emerging Fintech markets such as Africa or Latin America are lacking from Fintech Hubs.

As mentioned by Louise Brett, Head of Digital and Customer Analytics at Deloitte:

These Hubs already have the appropriate ingredients (i.e. specialised talent, progressive regulatory bodies, investment capital, government support, etc.) and the strong collaboration within the ecosystem that is required to develop leading global FinTech sectors, and which are capable of innovating across the financial services and technology landscape.

What about France?

Despite that France has no accelerator dedicated to FinTech, it still has a strong environment with a score of 77 that position the country at the 14th place. Some investment funds and banks are investing a lot in Fintech such as Credit Mutuel Arkéa, BPCE, XAnge PE or Partech Ventures. Success stories like Finexkap, Leetchi or Compte Nickel contributed to position the country as part of the global FinTech Hubs.

But according to the report, France should also focus more on attracting foreign startups, for example through a better regulatory framework.

You can have access to the full report on this LINK