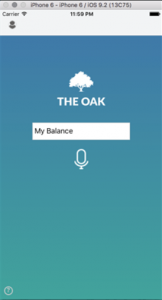

The Oak is a mobile app that gives people access to a smart financial assistant to help them better manage their savings and reach their financial goals.

Behing The Oak is an artificial intelligence technology that is interacting with its users to assist them in their everyday life.

The idea came for the team that what if our mobile became our personal coach in finance. We could talk to our mobile, as you now talk to SIRI to ask him questions on any topics, and receive targeted answers to all our financial concerns: what is my balance? Can my partner and I buy a house ? Is my credit card a good deal ? etc.

The great thing with The Oak is that the more you use it, the more it understand your specific needs and can answer complex financial questions. It takes the best out of machine learning and bring you a real time interaction with your savings.

You can open an account for free and synchronize your banking account. From there, The Oak will start understanding the way you manage your money, what are your regular expenses, how you deal with financial wellness, what are your priorities, etc. Users will then have to pay for premium services such as multi account and special offer purchases. For now, the start-up is using an e-money license from a provider to rapidly build its business.

The team recently announced a first seed round of £200,000 to launch the official public beta next December, that will include the initial assistant and the savings wallet. The round was made with Business angels and private investors.

The Oak’s vision is to make private banking artificially intelligent. This is a smart approach to lead to investing and eventually a robo-advisor business.