Could Chatbots have the same effects on mobile apps than Blockchain on the internet? The question is still hard to answer as we are still in the early days of Artificial Intelligence applied to bots.

However, one thing we know is that for the ‘first time ever people are using messengers apps more than they are using social networks‘ according to the media Chatbots Magazine. In a recent post, Christine Duhaime, founder of The Digital Finance Institute and Fintech influencer based in Canada, showed how big the opportunity was by pointing out the 2.5 billion people around the world that were now using daily messaging apps such as Facebook Messenger or WeChat.

Because the number of people using chatbots is expected to reach 2.2 billion by 2020, we thought that it would be interesting to highlight 5 chatbots that illustrate the potential of these technologies for financial services:

Personetics Anywhere

Personetics is a Tel-Aviv-based chatbot that provides a new way for financial institutions to engage with customers through messaging apps such as Facebook Messenger, Wechat, Skype and Amazon Alexa. Concretly, the chatbot allows banks to deliver timely insights and advice and satisfy their customers’ needs from the channels they are familiar with and whenever they want.

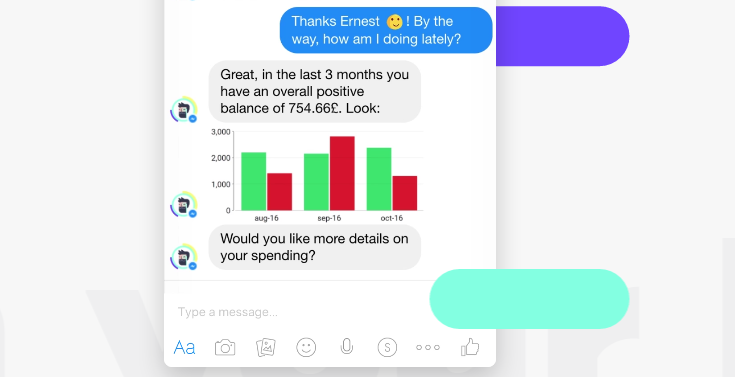

Ernest

Ernest is a London-based smart chatbot that answers questions and gives insights on its customers’ personal finances. Often compared as a ‘financial wellness coach’, it uses machine learning to help customers in the most efficient way and understand their needs to proactively provide them tips and notifications about the way they should manage their savings.

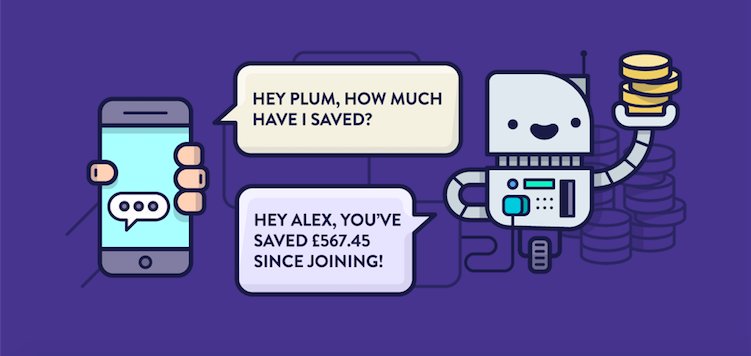

Plum

Plum is a London-based chatbot that has been developed by some of the early creators of Transferwise, the leading money transfer start-up. The chatbot describes itself as a ‘personal savings assistant’ which can give its users access almost instantly to their balances and chat with them to better understand their needs and expectations. The bot works with Facebook messenger and is still in beta test.

Finn.ai

Finn.ai (formerly know as Payso) is a Vancouver-based white-labelled virtual banking assistant, powered by artificial intelligence. Its ambition is to put a ‘personal banker’ in every customer’s pocket, helping them to manage their money wherever they are, whatever they need via a simple, natural conversation.

Abe

Abe.ai is a Orlando-based chatbot that develops a conversational banking solution for everyday people and community banks. It allows users to receive need-to-know updates on their money. Its ambition is to study the future cash flow of its users and plan out their financial week so that they never miss a bill and always know what the user can afford to spend.

That was quite interesting. Banking and chatbots are getting along very well these days. I was, however, thinking that you may want to include Engati as well. Engati is a chatbot platform that allows you to build, manage, integrate, train, analyze and publish your personalized bot in a matter of minutes. It presently supports eight major messaging platforms including messenger, Kik, Telegram, Line, Viber, Skype, Slack and Web chat with a focus on customer engagement, conversational commerce, customer service and fulfillment. Read more about it here http://www.engati.com

Hi Kumar,

Thank you for your last engagement!

Do you have any idea on their coverage in the banking industry? Do they have use cases with banking players?

Very much looking forward to hear back from you,

All the best,

Techfoliance Team