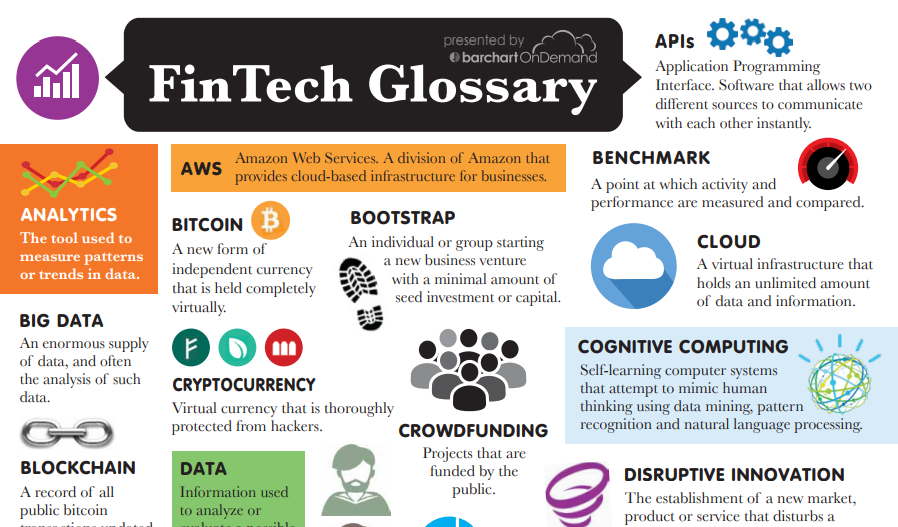

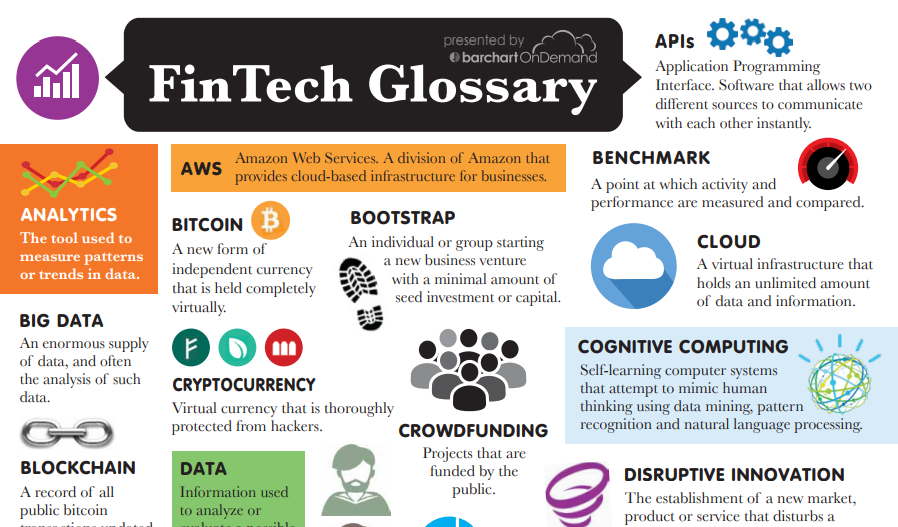

Machine Learning. Blockchain. Robo-Advisor. The use of these terms has been massively widespread over the past years. But do you really know the meaning of each one?

[divider]Fintech Glossary[/divider]

ANALYTICS

A tool used to measure patterns or trends for a specific project or development.

Ex: Rippleshot protects consumer credit information and the integrity of the merchant payment network by proactively detecting data breaches through a cloud-based solution.

API

Application Programming Interface. A programming process that is used by two different sources to communicate with each other instantly.

Ex: Barchart OnDemand is a cloud-based web service that allows you to power your apps, websites, charts and financial tools with off-the-shelf or custom financial data APIs.

BIG DATA

An enormous quantity of data, and often the analysis of such data.

Ex: Kaggle provides cutting-edge data science, faster and better than most people ever thought possible. They have a proven track-record of solving real-world problems across a diverse array of industries including pharmaceuticals, financial services, energy, information technology, and retail. Kaggle offers both public and private data science competitions and on-demand consulting by an elite global talent pool.

BITCOIN

A new form of independent currency that is held completely virtually.

BLOCKCHAIN

A record of all public bitcoin transactions updated in real-time.

CLOUD

A virtual infrastructure that holds an unlimited amount of data and information.

Ex: Cloudera offers enterprises one place to store, process and analyze all their data, empowering them to extend the value of existing investments while enabling fundamental new ways to derive value from their data.

COGNITIVE COMPUTING

Self-learning computer systems that attempt to mimic human thinking using data mining, pattern recognition and natural language processing.

Ex: Numenta is leading the new era of machine intelligence through the development of a cohesive theory, core software technology, and numerous software applications all based on principles of the neocortex.

CROWDFUNDING

Projects that are funded by the public.

Ex: Kickstarter aims to let creative people of all kinds — journalists, artists, musicians, game developers, entrepreneurs, bloggers — raise money for their projects by connecting directly with fans, who receive exclusive access and rewards in exchange for their patronage. More than just a fundraising app, Kickstarter’s a publishing platform where project creators can communicate with the people that are supporting them.

CRYPTOCURRENCY

Virtual currency that is highly protected from hackers.

Ex: Coinbase is a bitcoin wallet. With Coinbase, you can easily and securely buy and use bitcoin. Coinbase takes careful measures to ensure that your bitcoin is as safe as possible.

DIGITAL NATIVE

Young people who have grown up with the availability and use of digital technology.

Ex: Tykoon (currently in private beta) is a social and personalized financial services platform where kids can earn, save, give and spend real money.

DISRUPTIVE INNOVATION

The establishment of a new market, product or service that disturbs a pre-existing market or status quo.

Ex: Simple is reinventing online banking with modern web and mobile experiences.

FINNOVATION

A buzzword referring to innovation in the financial industry.

Ex: LikeFolio discovers powerful investment opportunities by tracking consumer enthusiasm for the brands and products behind tomorrow’s hot stocks.

FINTECH

A buzzword referring to financial technology or the firms involved in financial technology.

Ex: FinTech Exchange is a new event organized by Barchart OnDemand in association with FinTEx Chicago. FinTech Exchange is an engaging, solutions-focused event designed to communicate the latest in financial technology for financial markets and trading firms.

HACKATHON

An event for developers that consists of uninterrupted coding. Winners are usually determined by a panel, the public or their peers.

Ex: AngelHack organizes large hackathons, where developers learn new tools, meet new friends, and showcase their skills to the community. To date, they have organized almost 100 hackathons in 35 cities globally.

INCUBATOR

When a firm mentors a business, usually a startup, through developmental stages.

Ex: 1871 is a collaborative space where Chicago’s digital designers, engineers and entrepreneurs build their startups, share ideas, and change the world.

INTERNET OF THINGS

A proposed development of the Internet in which everyday objects have network connectivity, allowing them to share, send and receive data.

Ex: Humavox is a wireless power technology platform for effortless charging of multiple devices. Visit their website to learn about their unique technology.

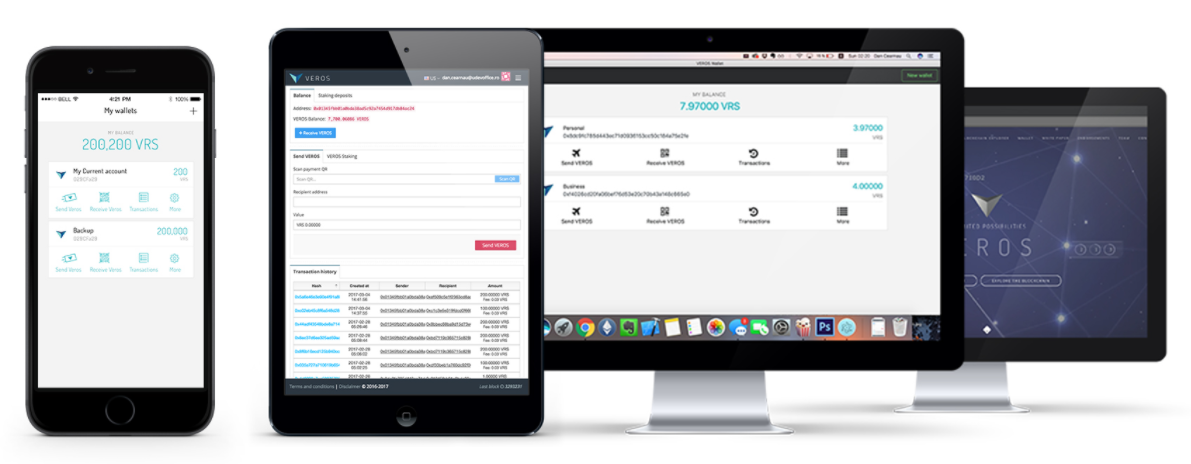

ONLINE BANKING

The ability to complete transactions, withdrawals or money transfers on the web.

Ex: Dwolla is a digital payment network that securely connects with U.S. banks and credit unions to enable safe, fast, account-to-account transfers.

ONLINE LENDING

Peer-to-peer money transfers online that don’t require a bank.

Ex: Prosper is a marketplace providing person-to-person lending utilizing a listing and bidding process to get competitive rates for loans.

PAYMENT GATEWAY

An online service provider that processes credit card transactions for online businesses.

Ex: PayLane is an online payments provider. We help e‑businesses accept online payments as smooth as possible and anywhere in the world. Delivering a vast variety of payment methods and currencies, PayLane allows businesses to reach more customers in selected markets.

ROBO ADVISOR

Financial advisement provided by a computer-based system.

Ex: Betterment is the smarter automated investing service, helping people to better manage, protect, and grow their wealth through leading technology. The service offers a globally diversified portfolio of ETFs, designed to help provide you with the best possible expected returns for retirement planning, building wealth, and other savings goals.

SAAS

Software as a Service. On-demand delivery of software to a user.

Ex: Workday offers enterprise-level software solutions for human resource and financial management.

This article was first published on Barchart OnDemand

The start-up is also using the blockchain to ensure privacy for its clients who can manage and see who has access to their data.

The start-up is also using the blockchain to ensure privacy for its clients who can manage and see who has access to their data.