Gone are the days when creating a product took precedent over identifying a target market.

Steps to build your venture in the 21st century

A century ago, it was common practice for industrialists to come up with an idea, manufacture the product, and then figure out a way to get people to buy. In his book, My Life and Work, Henry Ford famously said, “Any customer can have a car painted any color that he wants so long as it is black.” In a time when the average citizen was still getting used to the idea of having spending money, there was nothing wrong with an approach to product development and launching that had little regard for customer needs. Now, as we get further into the 21st century, this approach to product development – or lack thereof – is no longer a viable way to create a product.

The most important step when developing any type of product is the identification of your customer and their needs. Without an in-depth understanding of the pains of your target customer, you will never be able to develop a fully viable product that is going to drive someone to want to buy it.

Once you’ve identified a target market, thoroughly understand their needs, and develop a product to satisfy those needs, you may move on with your development of a go-to-market strategy. Figuring out how to reach this newly identified group of potential customers is your next pressing issue. The primary decision in this step is deciding whether to sell directly or indirectly to the customer. Directly selling your product may include having an in-house sales team, while indirectly could take the form of having a trial of your software placed in new consumer devices.

Pricing is the final step in this simplified process. When developing a pricing model, it is important to look at factors other than simply the cost of production. If the customer is gaining hundreds of dollars worth of benefit, and you’re only charging a fraction of that, there is a lot of money being left on the table. Additionally, it is important to analyze how much money you are spending in order to gain each customer. If you are spending more money on customer acquisition than you are gaining in profits, something needs to be changed.

The case of the Fintech industry in Israel

One exciting industry that has been rapidly developing over the past few years is the Fintech industry. Part of the success of this sector comes from the fact that the entrepreneurs behind each company develop their product only after understanding an existing need.

On Nov 22nd, FinTech-Aviv, largest Israeli Fintech community, is going to host at Rise Tel Aviv, a discussion about Growth Strategies for Global Markets. Agenda will include four interesting FinTech companies that will present their Go-To-Market strategies:

Paykey – developed a unique technology that enables payments within any social network, including Facebook, WhatsApp, Twitter, etc. – will share their input regarding penetration to the South American market.

Paykey – developed a unique technology that enables payments within any social network, including Facebook, WhatsApp, Twitter, etc. – will share their input regarding penetration to the South American market.

CRiskCo – A credit risk analysis and management platform that offers novel business credit reports and enable credit providers to better evaluate their risks when facing credit applicants – will share their input regarding penetration to the North American market.

CRiskCo – A credit risk analysis and management platform that offers novel business credit reports and enable credit providers to better evaluate their risks when facing credit applicants – will share their input regarding penetration to the North American market.

PayBox – An eWallet for groups, teams, and communities who wish to collect, manage and spend money collectively. The ultimate solution for gifting, joint vacations, ticketing, PTAs, after school activities, donation and charities – will share their input regarding penetration to the UK market.

PayBox – An eWallet for groups, teams, and communities who wish to collect, manage and spend money collectively. The ultimate solution for gifting, joint vacations, ticketing, PTAs, after school activities, donation and charities – will share their input regarding penetration to the UK market.

Flymoney – ly2Market, a plug & play solution developed by Fly Money enables airlines and OTAs to offer their travelers 30 different currency exchange options, with highly competitive prices and in hand delivery at the airport – will share their input regarding penetration to the Spanish market.

Flymoney – ly2Market, a plug & play solution developed by Fly Money enables airlines and OTAs to offer their travelers 30 different currency exchange options, with highly competitive prices and in hand delivery at the airport – will share their input regarding penetration to the Spanish market.

Keep following FinTech-Aviv updates on meet-up page and website

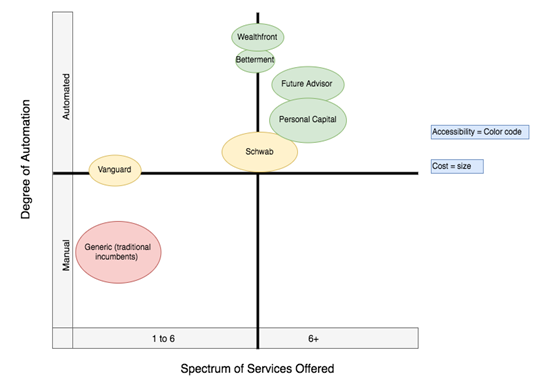

The company focuses on passive investors who prefer full automation, as shown on the y-axis. The company targets millennials, who are cost sensitive due to their lower asset base. Our visual framework reflects Wealthfront’s competitive advantages in customer interface innovation or accessibility, breadth of service and cost-to-serve.

The company focuses on passive investors who prefer full automation, as shown on the y-axis. The company targets millennials, who are cost sensitive due to their lower asset base. Our visual framework reflects Wealthfront’s competitive advantages in customer interface innovation or accessibility, breadth of service and cost-to-serve.