We have reached an interesting time in the banking sector where big banks’ models are switching from ‘Too big to fail’ to ‘Too big to move’.

We all know the economical concept behind ‘Too big to fail’. Big banks have long been immune from bankruptcy thanks to their size. Governments promised them a ‘never ending bailout contract’ to protect them against any future crisis. This to avoid the entire market to collapse if a major bank was to fail. Few weeks ago, the European banks were calling for a €150 Billion bailout to recapitalize.

However, no organization on earth can protect a big bank against competition, even the regulators are in favor of new smaller entrants. Size was the standard until FinTech start-ups came out with new approaches:

“Size will no longer dictate the laws of finance but flexibility is the new Graal”.

The great thing with FinTech is that compared to banks they are agile by nature which allow them to innovate much faster. That is why we have seen FinTech start-ups growing so fast over the past years.

Some would argue that as it is the case for Banks, FinTechs will need to reach a critical size to challenge traditional actors and compete with other new entrants. That is right, but I believe there are at least two major factors that benefit to smaller actors: specialization and time.

‘Too Big …’: being big does not mean being good at everything

Some big banks are good in retail banking and some others in investment banking. Some will be better at trading and some others at managing people’s wealth. But not a single bank on the market is providing top quality services in every vertical.

Most FinTechs are focusing on one specific financial vertical. Whether it is lending, payment, money transfer, investment, etc. specialization is driving excellence in the new financial game. This give FinTech much more flexibility to adapt to customer’s needs and offer them a better user experience, better returns, cost reductions and even more transparency due to the simplification of the processes.

It also seems obvious but in finance the bigger you are, the more you are regulated and the more complicated it is for you to make a move. Alain Clot, President of France FinTech, correctly explained in an interview the main issues for banks in terms of regulation:

“Fintech or not, regulation is the same for everyone. The difference is that as a bank, dealing with every financial products and services means being regulated for each of these products and services. FinTechs are usually targeting one vertical and are regulated for a specific product or service.”

Even the so called ‘neo-banks’ which tend to offer a wide range of financial services are instead focusing on one vertical (at least for now). N26, a German neo-bank formerly known as Number26, started as a mobile payment actor. The start-up has spent the last few years working on innovative payment solutions for its customers. It has recently received a full banking license from the ECB to operate as a real bank and extend its financing products. Similarly, the services offered by the French Morning or the British Tandem and Revolut are restricted to payment but not yet savings or lending solutions.

Because the success of FinTech relies on trust and confidence, new entrants have to build step-by-step the bank of the future. As a result, we are entering in a new time space.

‘… to move’: time was money, now time is value

Time is a very interesting factor when looking at the new financial landscape shaped by innovation. Banks and FinTechs have a completely different relationship with time.

Banks are running out of time. They have no more time on the financial markets. If they want to be competitive, they have to be the fastest. No more time neither for customers unless they have a personal wealth to pay for expensive advices.

The funny thing is that for a bank that is investing massively to be the quickest on the market, it appears to be much more time consuming for it to digitalize. So here we come with the concept of ‘Too big to move’. For those who’ve been working in the banking sector, you probably experienced the negative effects of that big machine where nobody quite really understands what’s going on. To this, you add many hierarchy levels, poor decision processes, a lack of transparency across business lines, etc. in which innovation is supposed to find its path. You get it, you can’t move in such a huge structure unless you start thinking differently.

We have seen lot of acquisitions over the past months with banks like BBVA or Goldman Sachs making up for lost time. Banks are good at investing but integrating is another challenge for every reasons mentioned before. It takes more time to integrate a technology (and everything that goes with it such as the culture and the vision) to a business. And time, banks are lacking of it!

Temporality is not the same for FinTech start-ups. FinTechs are not competing on speed but on something more humanistic: the customer experience. It takes months to build a brand from scratch and months to be trusted by your customers. This give FinTech obviously more time to take strategic moves against potential competitors.

The French neo-bank ‘Compte Nickel’ is a great example of how fast and agile a FinTech can be. Philippe Gelis, founder & CEO of Kantox, described ‘Compte Nickel’ in an article as the most successful neo-bank in Europe. In only 27 months, more than 300,000 people opened an account and revenues of nearly 9 million euro were made in 2015. All this with almost no money invested in marketing. I agree it is ‘peanuts’ compared to the 42 something billion euros of revenues made by BNP Paribas in 2015. But customer behavior is changing and 300,000+ people now prefer to go to newsagent shops to open a bank account rather than go to bank branches.

Banks are investing in innovation to be more flexible. Being ‘too big’ means that banks don’t have the ability to move as fast as they would like to innovate. This create a bunch of opportunities for both FinTechs that are flexible but need to scale and banks that are big enough but need to move quickly to reinvent themselves.

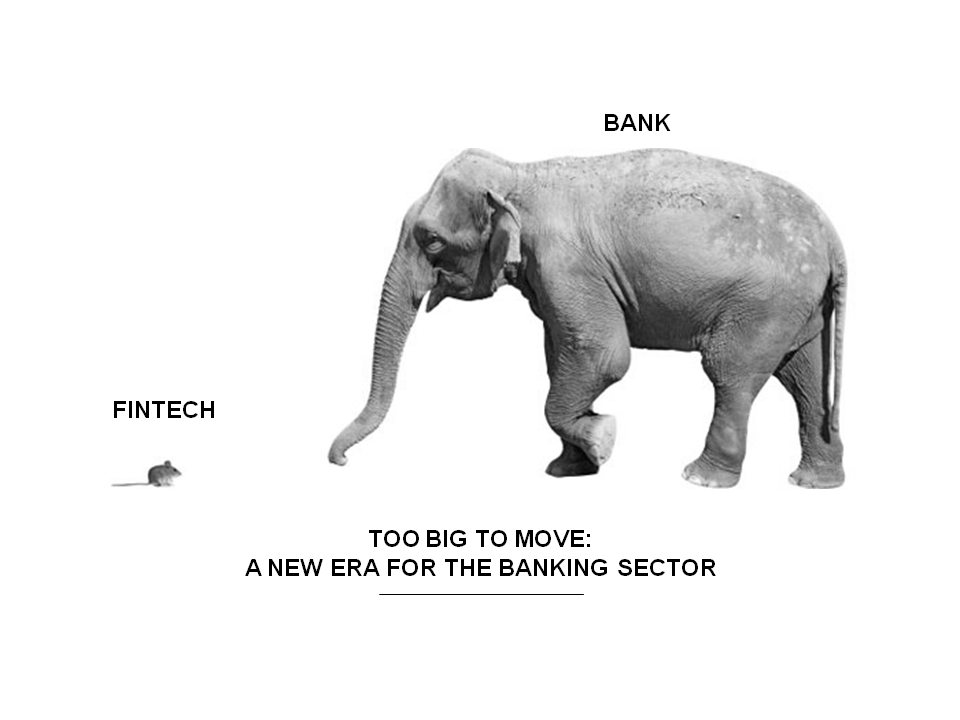

Chris Skinner also used the old story of the mouse and the elephant as illustration to describe the relation between banks and FinTechs but I will re-use this metaphor since I find it particularly relevant to conclude this article.

Big banks are the fat elephant that have long been sure about their superiority in the financial jungle. Now with the arrival of FinTech start-ups, characterized as the little mouses, the balance of power is evolving, giving more space to the rise of new innovative concepts. Both Banks and FinTechs can benefit from the fundamental shift the financial sector is experiencing. Whether it will be through collaboration, coopetition or through competition, at the end of the day, the customer will have the final word on what is the best approach to manage his/her savings.

Note: I would like to address a special thank you to all those who shared their vision with me on the topic, more specifically to Patrice Bernard and Janos Barberis for their highly valuable feedbacks!