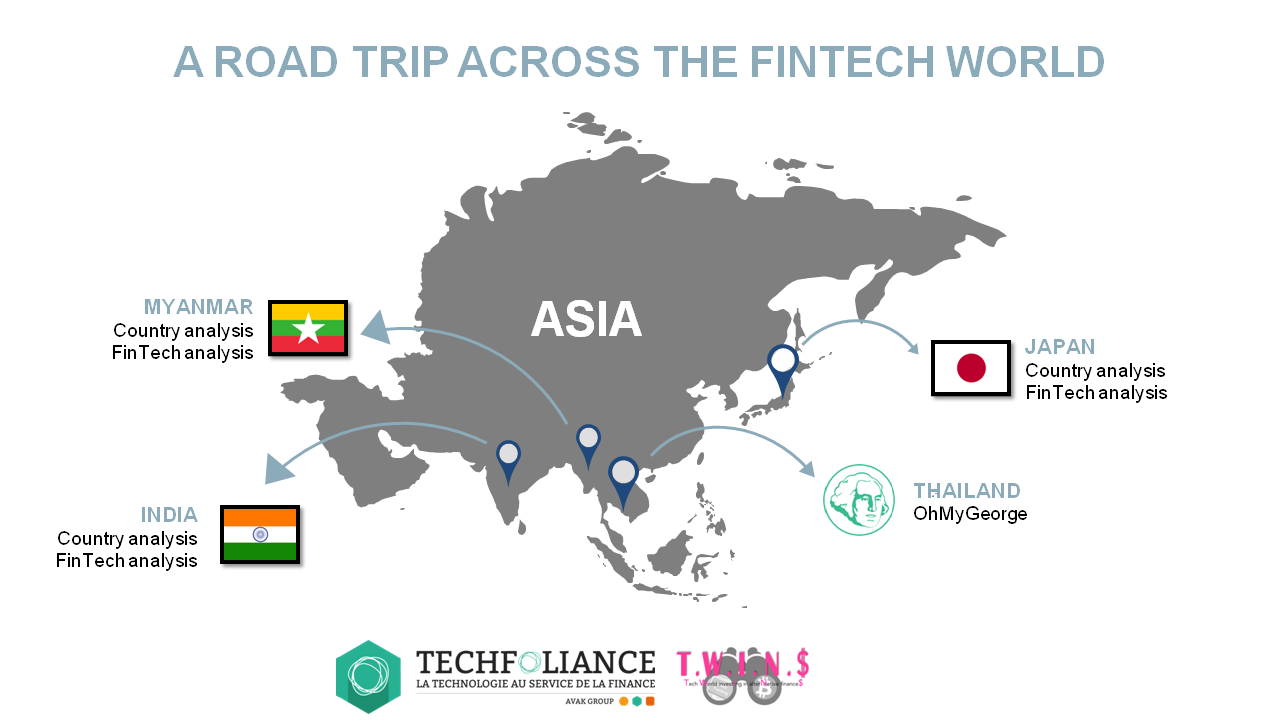

Techfoliance and The Fintech Twins are travelling together to meet game changers in finance around the world. We want to help you understand the potential that these technologies could have in people’s life in every part of the world.

India is the fastest growing start-up ecosystem in the world with 11,500 start-ups expected by 2020. With most of the population living in rural areas, the FinTech sector will face diverse challenges to reach the mainstream.

We wanted to understand what could be the solutions to meet the needs of the unbanked part of the population, what were the financial services being used by the population : payment, money transfer, saving, etc. ? As well as the type of infrastructure they could rely on to allow financial revolution : post offices, smartphones, etc. ?

We met entrepreneurs and went on to ask directly to the indians to know more about the financial sytem, here is what we discovered :

Fintech in India – Key figures

INDIA

1.26 billion people are living in India

70% of the population live in rural areas

MOBILE INCLUSION

94% of transactions are made in cash

1 billion phones in india

29% of Indians will have a smartphone by 2019

FINANCIAL INCLUSION

60% of people are unbanked

90% of SMEs have no link with formal financial institutions

Country analysis : Fintech in India

FinTech analysis : coming soon

FinTech analysis : coming soon

Country conclusion : coming soon