Techfoliance is extracting key data and facts from industry reports on the rise of Fintech in Europe so that you can focus on what matters the most for you.

In this report published on September 2017, the consulting firm EY shared key insights on the growing number of FinTech start-up in the region, investment volumes in the sector that are expanding, the rising deal flow that and the increasing average deal size.

[divider]FINTECH FIGURES[/divider]

In 1H’2017 FinTech start-ups in Germany raised around EUR 307 million of VC funds with average deal size of EUR 7.3 million.

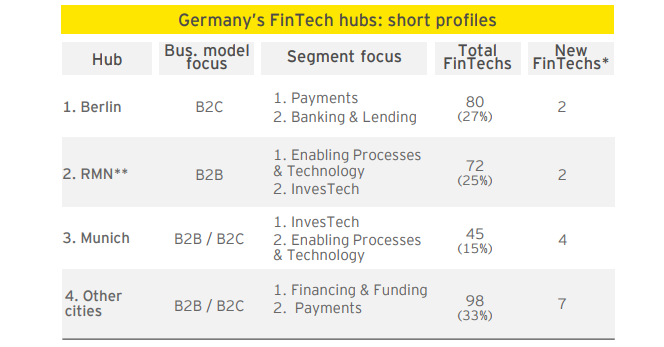

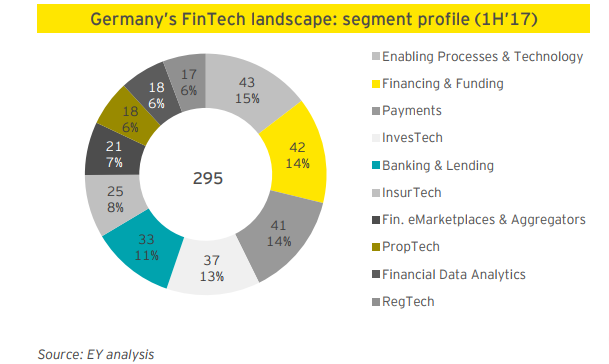

The German FinTech landscape accounts about 300 active FinTech in total with Berlin being country’s largest FinTech hub, hosting 27% of them.

Around 67% of all FinTech are located in the 3 major Gemran FinTech hubs that are Berlin, Rhine-Main-Neckar (RMN) and Munich.

Around 42% of FinTech start-ups in the country are B2B-oriented.

Between 2012 to 2016, total investment in German FinTech start-ups increased by almost 40x from EUR 10.2 million to EUR 398.9 million.

[divider]FINTECH FACTS[/divider]

Top FinTech funding deals in 1H’2017

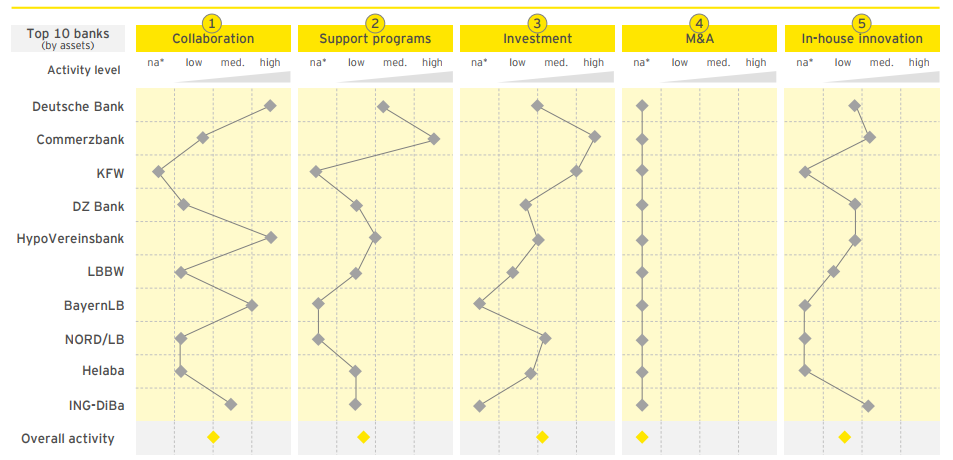

Among the top-10 largest banks, investments and collaborations have been by far the most preferred response strategy to FinTech.

Germany’s FinTech hubs: short profiles

Germany’s FinTech landscape: segment profile (1H’17)

Read full study here