Join Techfoliance next September 2018 the 20-21th in Paris to attend Global Innovation Institute (GI2) at Le Meridien Etoile in Paris, France, one of the most important event regarding Transforming Capital Markets through Technology.

GI2 At a Glance

IMN, in partnership with the Association for Financial Markets in Europe (AFME), will host the Global Innovation Institute (GI2). This inaugural gathering will bring together senior executives and their teams who are driving strategic innovation in technology and operations from Europe’s leading financial institutions.

You can see few speakers here:

- Steven Maijoor, Chair, European Securities and Markets Authority (ESMA)

- François Villeroy de Galhau, Governor, Banque de France

- Samir Assaf, Chief Executive Officer, Global Banking and Markets, HSBC

- Richard Radley, Lead, Customer Engineering, Google Cloud, Google

- Lex Sokolin, Global Director Fintech Strategy, Partner, AutonomousNEXT

Why you should come?

For this first edition, Global Innovation Institute (GI2) is gathering more than 500+ senior executives and their teams who are driving strategic innovation in technology and operations from Europe’s leading financial institutions. (GI2) is an invite-only event focused on transformation of Capital Markets through Technology. During the two days event, C-level will have the chance to meet with entrepreneurs, investors and experts.

The unique feature of this programme is its visionary and forward looking agenda focused on what capital markets may look like in 20+ years, which is key for planning strategy in the immediate term.

The conferences will be conducted around Capital Markets key topics such as:

Diversity – Women in FinTech: Is Gender Equality Here ?

Transformation – Applying Agile Transformation to Capital Markets

Cyber Risk – Building institutional resiliency by ensuring redundancy and recovery procedures are in place. Identifying the emerging risks and appropriate measures to prepare for them.

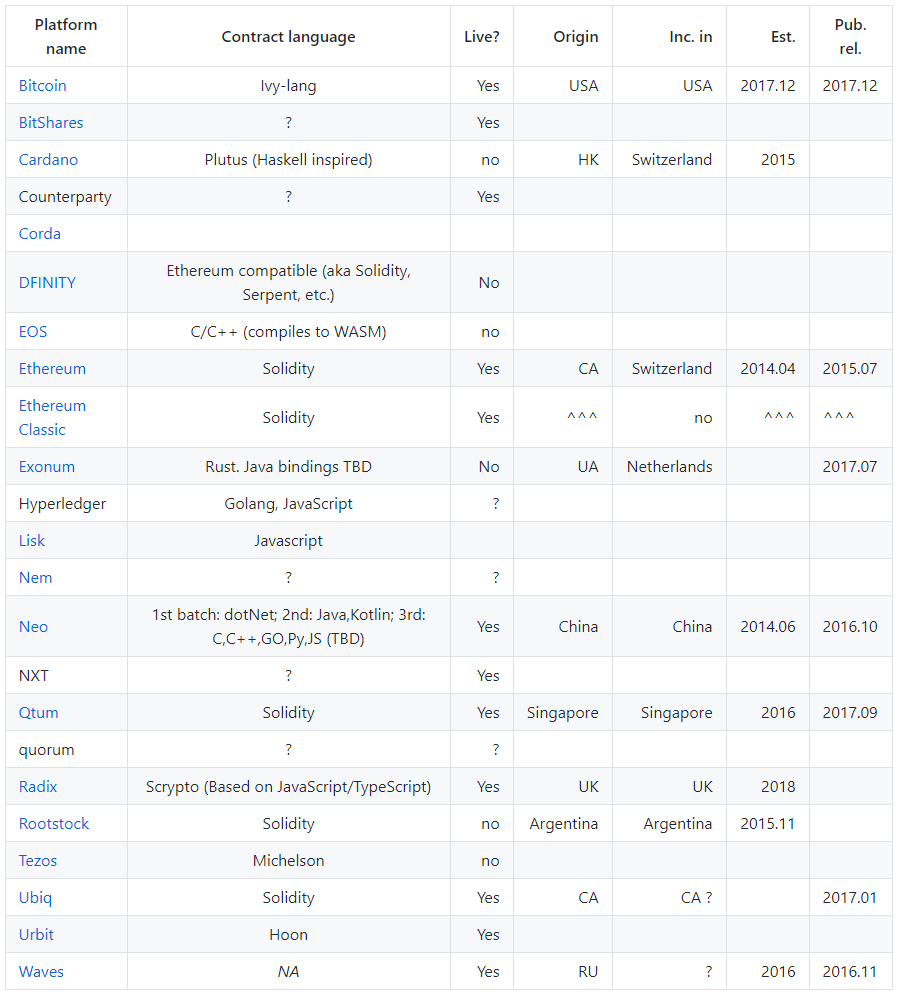

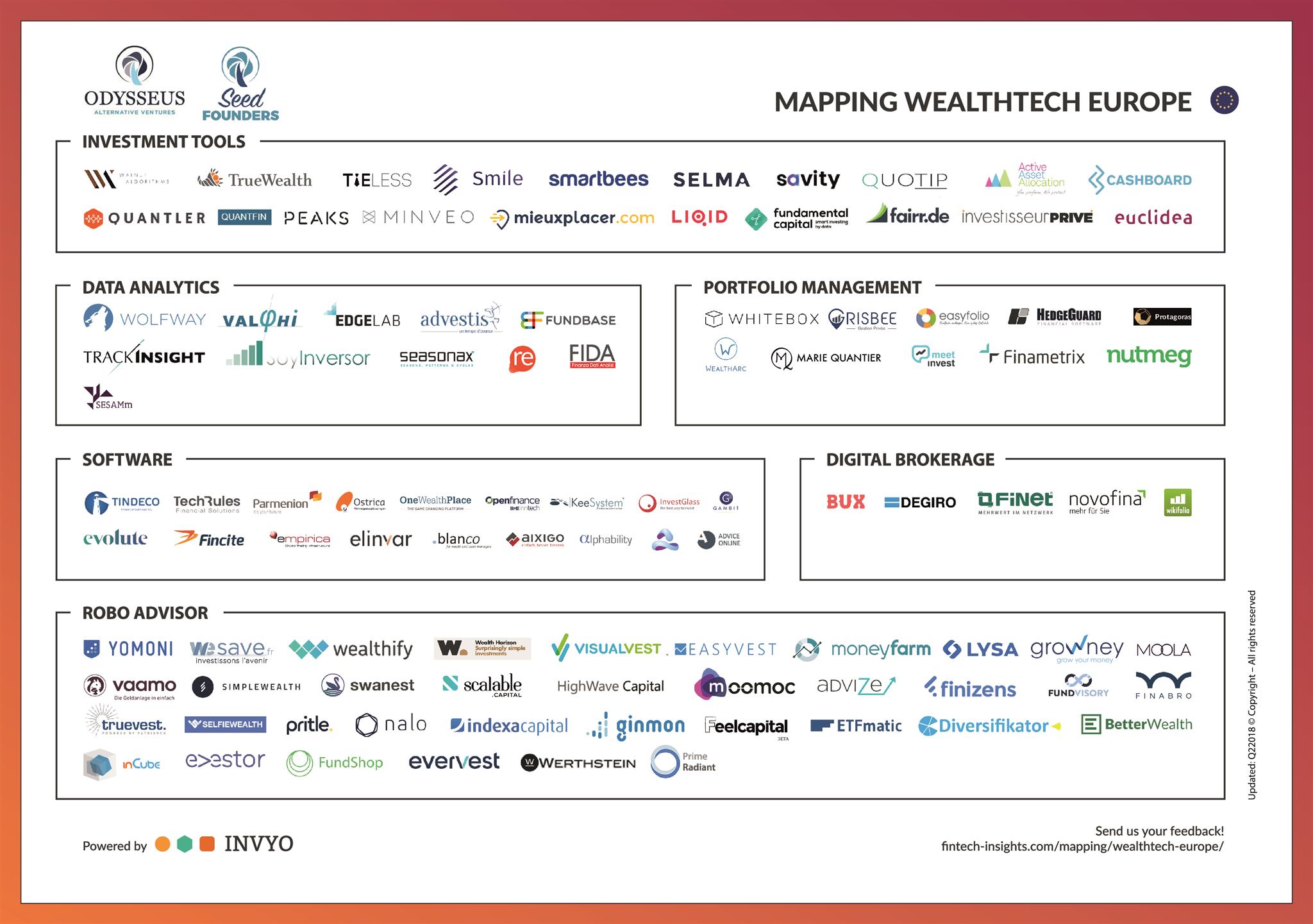

Emerging Technologies – Artificial Intelligence and Its Applications in Capital Markets

Regulation – Ensuring regulatory compliance with emerging frameworks on data protection, cybersecurity, MiFID II. Fostering dialogue between market participants and policy makers.

Workforce 2.0 – Workforce of Tomorrow: Roles, Skills and Technologies

See agenda for full event details

Techfoliance is glad to come to this event as a media partner. We will forward you with daily live news so that you can follow the best of Global Innovation Institute (GI2) if you did not have the chance to come directly to Paris to attend the event.

Do not hesitate to contact us before if you want to manage a meeting with our team to share thoughts, become a contributor or pitch your Fintech to be featured on our media!