The topic of FinTech, describing the highly innovative and fast-pacing Financial Technology sector, globally gained more and more importance in recent years.

Israel: A Global Provider Of FinTech Innovation

Israel is a strong promoter of FinTech Technologies and a global provider of Innovation. The unique characteristics of the Israeli market create a fertile ground for innovation.

There are over 500 FinTech ventures in Israel, only 10% of them are providing services in Israel. Being a country in the Middle East with only 8.7 million people, Israel based ventures look globally and aim to solve issues in foreign countries.

Israeli government promotes innovation to its core, as innovation is Israel’s most valuable export, dedication to research and development is unparalleled. It is by far the world leader in R&D with 20% of the nation’s GDP devoted to this field. It is also the world’s most VC funded society, with more funds per capita than any other nation.

Overview Of The Polish FinTech market

More European countries are demonstrating FinTech Innovation using modern technologies to interact with the end customer, and supply wide variety of financial services adapted to the market demand.

Taking a closer look at CEE countries, Polish FinTech market presents immense potential with a market estimated in 900 million Euro. The Polish market is defined with urban and rural areas that demand high technological awareness, which leads to heightened expectations.

When looking at the banking system in Poland, nearly 80% of the market is dominated by private banks; additionally, there is a governmental support for local ownership of the banking sector with help of acquisitions of foreign-owned banks by state-owned banks. The 5 leading banks in Poland holds more than 50% of the market share and are in constant search for innovative solutions promoting better financial services to their clients.

The banked Population is reaching 78%, which translate to 8.3 million polish residents that are unbanked or underbanked. Poland has a large rural area, which represents 40% of the Polish landscape. Combined, these unique characteristics are hidden opportunities for FinTech innovation.

Collaboration Between Israeli And The Polish FinTech Ecosystem

Poland can benefit from highly developed Israeli FinTech solutions that operate and have experience in other global ecosystems. Taking in consideration the conditions in the Polish market Israeli ventures have much to offer.

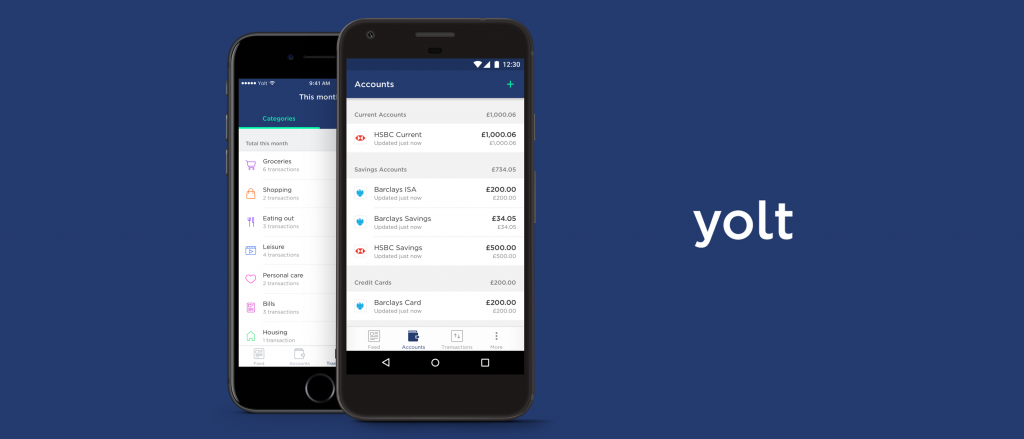

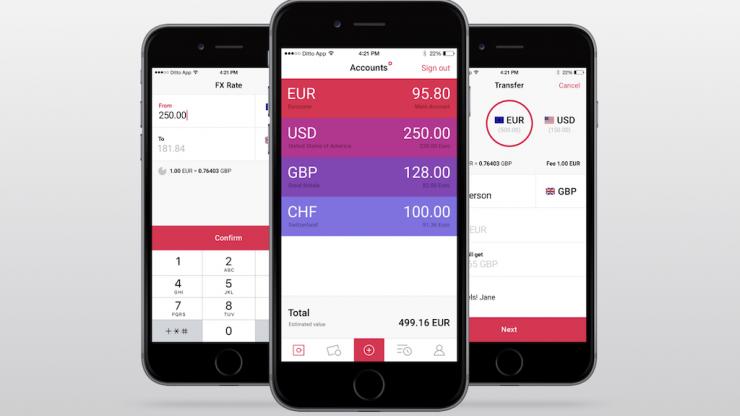

As cybersecurity plays a significant role in Israel, many companies are dealing with this FinTech complementary vertical as authentication or anti-fraud. Additionally, there are innovative customer engagement solutions and onboarding processes that can mitigate the gap of the underbanked and unbanked to financial services. Automation systems to conduct KYC processes and providing remote underwriting services.

Growing relationships between the Israeli and the Polish FinTech ecosystem will no doubt benefit both counterparties.

For this reason, Equitech is proud to lead the Israeli FinTech Innovation delegation to Poland. The delegation will participate at the Impact FinTech 2017 summit which will take place on December 6th, 2017. The delegation will include a sample of Israel Innovation with promising Israeli based start-ups who are looking for collaborations. You will be able to find Client Engagement tools, Cyber Security, RegTech, and Process Automation solutions to assist in bridging the gap in FinTech.

About Equitech:

Equitech is a consultancy firm providing innovation scouting services to financial institutions and business development services mainly to FinTech ventures with ready to market products. Currently working with a couple of dozens of FinTech and Cyber Security Start-ups, introducing the Israeli FinTech eco-system to global financial institutions.

About Fintech-Aviv:

Equitech is Also leading FinTech-Aviv community, one of the world’s largest FinTech communities, consists of more than 4,500 entrepreneurs, FinTech ventures, financial institutions, leading professionals and investors.