Sequoia, a San Francisco-based VC fund that invested in Apple or Google, recently raised a $900 million fund to back innovative start-ups in India. With more than 3 billion under management, the fund is the most active in the country.

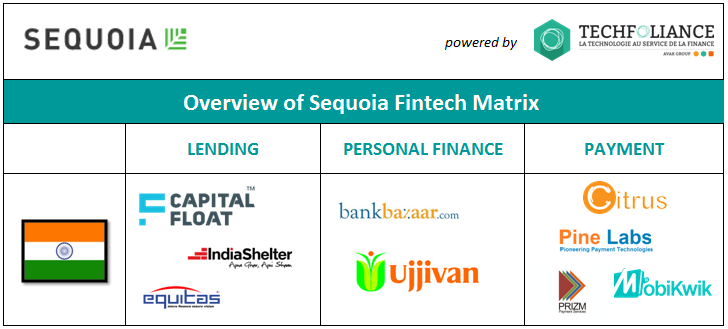

Up to date, the venture capital fund has invested in 9 Fintech companies splited in the following categories :

Below is a list of 9 fintech start-ups that communicated their fundraising to the public. Please be aware that Newfund may have invested in other Fintech but did not communicate on them.

[divider] Lending [/divider]

Capital Float – An online platform that provides working capital finance to SMEs. The FinTech raised $25 million last week.

India Shelter Finance – A housing finance company providing loans to financially excluded families.

Equitas – The platform provides micro credit to people who are unable to access financing from the mainstream banking channels.

[divider] Personal finance [/divider]

Bank Bazaar – The platform helps consumers choose the right financial product for their needs.

Ujjivan – The platform provides financial services to the economically active poor to enable them to build a better life.

[divider] Payment [/divider]

Citrus Payment – A comprehensive web and mobile payments solutions for merchants and consumers.

Pine Labs – A leader in payments and loyalty solutions for retail companies.

Prizm Payment Services – A leading provider of secure and innovative payments, mobile and card services.

Mobikwik – A leading mobile wallet company that enables consumers to transact offline and online.

![[NEW] Top 10 VC funds in Fintech in Israel](https://insights.invyo.io/europe/wp-content/uploads/2017/03/Techfoliance_vc-fund-fintech-israel_mapping.png)

nice post