- IMPACT

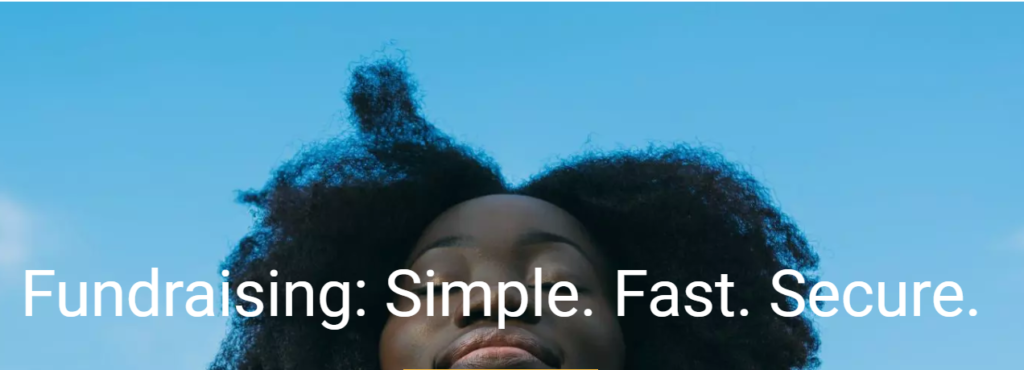

What business impact does the solution have on the end customer/client ?

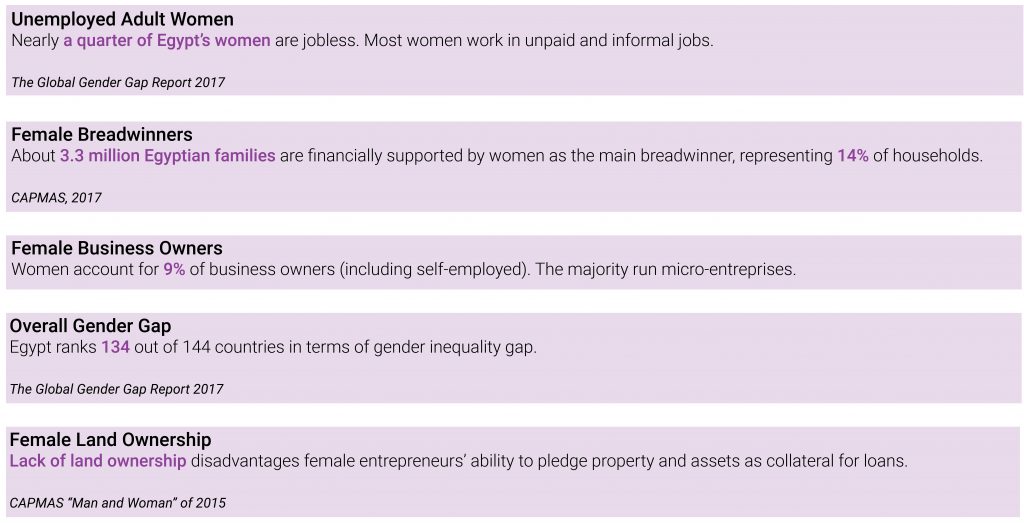

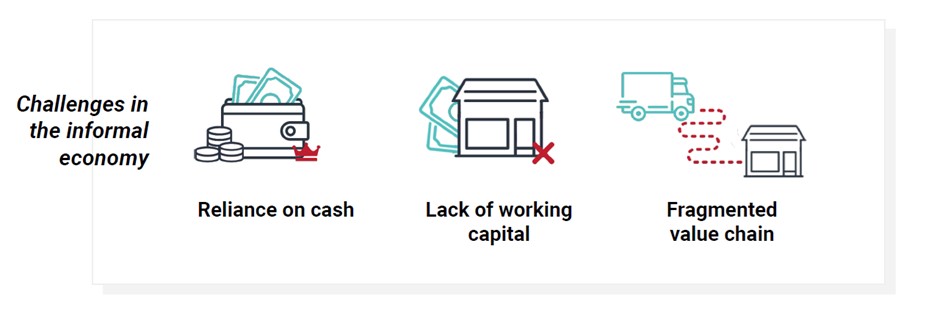

Trader Solutions provides access to new lines of business, credit and savings services for millions of informal merchants across 14 African countries – all without having to set foot in a bank branch or leave their points of sale.

For the traders using this service, this means a boost to ongoing trade, increased return customers and the sale of additional goods and services. Traders using the platform typically see an increase of around 30% in activity rates.

We have already demonstrated the sustainable provision of working credit advances in real-time through the platform. For traders who take out loans through the platform, nearly 80% of sales are funded by credit. This frees up the working capital that would be otherwise tied up in stock, allowing traders to redirect finances for other purposes.

Traders report that they value two things: (1) being treated like a business for the first time – accessing financial services such as credit through their business instead of having to use their personal services to finance business activities (which typically attract much higher interest rates) and (2) not having to close their business to go to a bank or other financial service provider – that financial services are brought to them at their business premises.

Additionally, access to sufficient working capital ensures retailers can stock the widest and best quality range of products needed to provide their communities with access to the everyday essentials taken for granted in many parts of the world.

What are your key KPIs/results?

The short term target is to reach one hundred thousand retail traders. As each trader reaches hundreds of consumers each month, translating into a positive ripple effect to tens of millions of consumers.

Nomanini also track the number of loans taken out, optimise for the lowest default rate possible (less than 1%), the number of sales made under loan and the activity rates of merchants before and after taking loans.

Long term, the key result is launching Trader Solutions in 14 countries within Standard Banks African footprint. Nomanini are currently live in 2 and have 6 more planned for 2021.

- WOW FACTOR

How does this collaboration differentiate you in the market?

While there are many bank + fintech collaborations, Nomanini believes this partnership is one of the first large scale partnerships in Africa and the only pan-African collaboration bringing MSME banking to the informal retail trade.

Nomanini and Standard Bank and uniquely placed to deliver this solution and to reengineer the rails, and rewrite the rules of informal retail trade in Africa so the informal traders can thrive rather than just survive.

According to Nomanini, the partnership is a culmination of shared vision for a prosperous Africa.

If you want to read the Part 1 click here !