Financial inclusion does not only mean giving people access to traditional financial products and services, it also means teaching people the basics of finance to help them better understand how to save or pay.

Alberto Gómez and Gabriel Lopez launched Monee last year to try to reduce financial illiteracy across Latin America with first roots in Colombia.

In a recent interview made to Banknxt and conducted by Phil Siarri, Alberto Gómez said:

“Our mission is to help people manage their money for their own benefit. We think that Monee can help users reach a better life and stop stressing out about financial matters”.

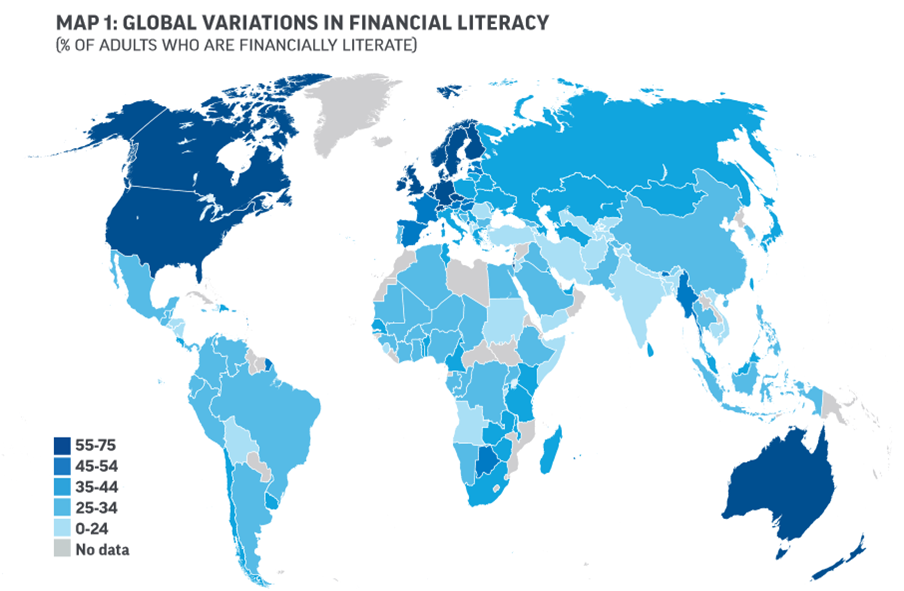

According to a recent survey published by S&P Global FinLit, Latin America is lagging behind in terms of financial literacy:

The team aim to bring tangible and simple educational tools to assist people in managing their personal finance through products like a mobile app, e-books, online courses or newsletters. Right now, most of the content is shared in Spanish.

Monee wants to teach people the basics of finance in order for them to take their own financial decisions while avoiding the risks associated to fraudulent offerings.

Financial education is a real concern in Latin America and we need more actors like Monee to let people understand what is done with their savings in countries where most people are still financialy excluded.