Mexico is set to position itself as the capital of Fintech in Latin America. More and more Fintech start-ups are being created in Mexico to promote financial inclusion and bring new solutions to pay, transfer, manage or access capital.

To give you a better understanding of the market size, Techfoliance LATAM is showcasing key figures that you must know regarding Fintech in Mexico:

Key FinTech Figures Mexico

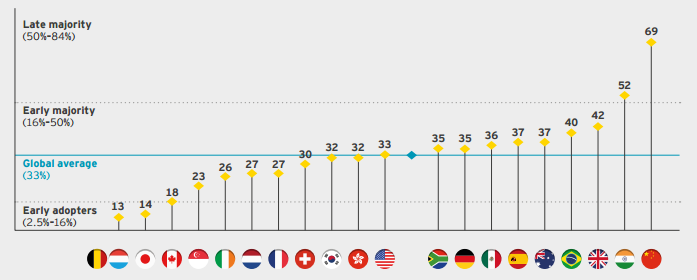

According to EY Fintech Adoption Index 2017, Mexico is the 7th country worldwide with the highest adoption rate in Fintech estimated at 36%, and is 2nd in LATAM behind Brazil (40%).

According to Finnovista, the biggest Fintech segments in Mexico are: Payments & Remittances (30%), Lending (22%), Enterprise Financial Management (13%), Crowdfunding (10%) and PFM (9%).

The potential savings for Mexico if fraud in the banking system is stabilized to acceptable levels would save around 3% of GDP.

In 2014, the e-commerce market was valued at a record high of 162,100 million pesos.

In 2016 alone, more than 80 million pesos were invested in Fintech start-ups and the amount is expected to double in 2017.

According to the Mexican Fintech Association, there were 160 Fintech companies in 2016 in Mexico and the number should increase to 200 by the end of 2017.

Feel free to add more figures related to the Mexican Fintech Landscape in the comments below!